When severe weather strikes the Texas Panhandle, property owners face a critical window of opportunity to document roof damage and file successful insurance claims. Understanding what insurance adjusters specifically look for during roof evaluations can mean the difference between a fully covered replacement and costly out-of-pocket repairs. In Amarillo's harsh climate of extreme temperature swings, devastating hail storms, and wind uplift forces exceeding 90 mph, delaying this process can allow minor damage to escalate into catastrophic building envelope failures that insurance may no longer cover.

The consequences of inaction are severe in our region. What begins as compromised membrane seams or granule loss can quickly progress to moisture intrusion, structural damage, and complete roof system failure when exposed to our relentless sun and sudden temperature drops. Insurance adjusters operate on strict timelines, and evidence of neglect can void coverage entirely.

When Roof Damage Requires Professional Insurance Evaluation

Insurance adjusters are trained to identify specific damage patterns that distinguish covered perils from normal wear and maintenance issues. In the Texas Panhandle, they focus intensively on impact damage from hail, which creates distinctive fracture patterns in asphalt shingles and puncture marks in metal roofing systems. Wind uplift damage presents as lifted or missing shingles, exposed fasteners, and compromised flashing systems.

Professional evaluation becomes essential when you observe granule accumulation in gutters, visible mat exposure on shingles, or denting on metal surfaces and HVAC equipment. According to the Insurance Institute for Business & Home Safety, hail stones as small as one inch can cause significant damage that may not be immediately visible to untrained eyes.

Adjusters also scrutinize the building envelope's thermal performance. They look for thermal bridging, compromised R-value integrity, and evidence that the roof system can no longer maintain proper energy efficiency. In our extreme climate, these factors directly impact habitability and structural longevity.

The evaluation process must occur promptly after weather events. Insurance policies typically require notification within 30-60 days of discovery, but in practice, the sooner documentation occurs, the stronger your position becomes for claim approval.

Key Decision Factors: Repair Versus Replacement Coverage

Insurance adjusters apply specific criteria when determining whether damage warrants partial repair or complete roof replacement. The critical threshold typically involves damage affecting 25% or more of the roof surface, though this varies by carrier and policy language.

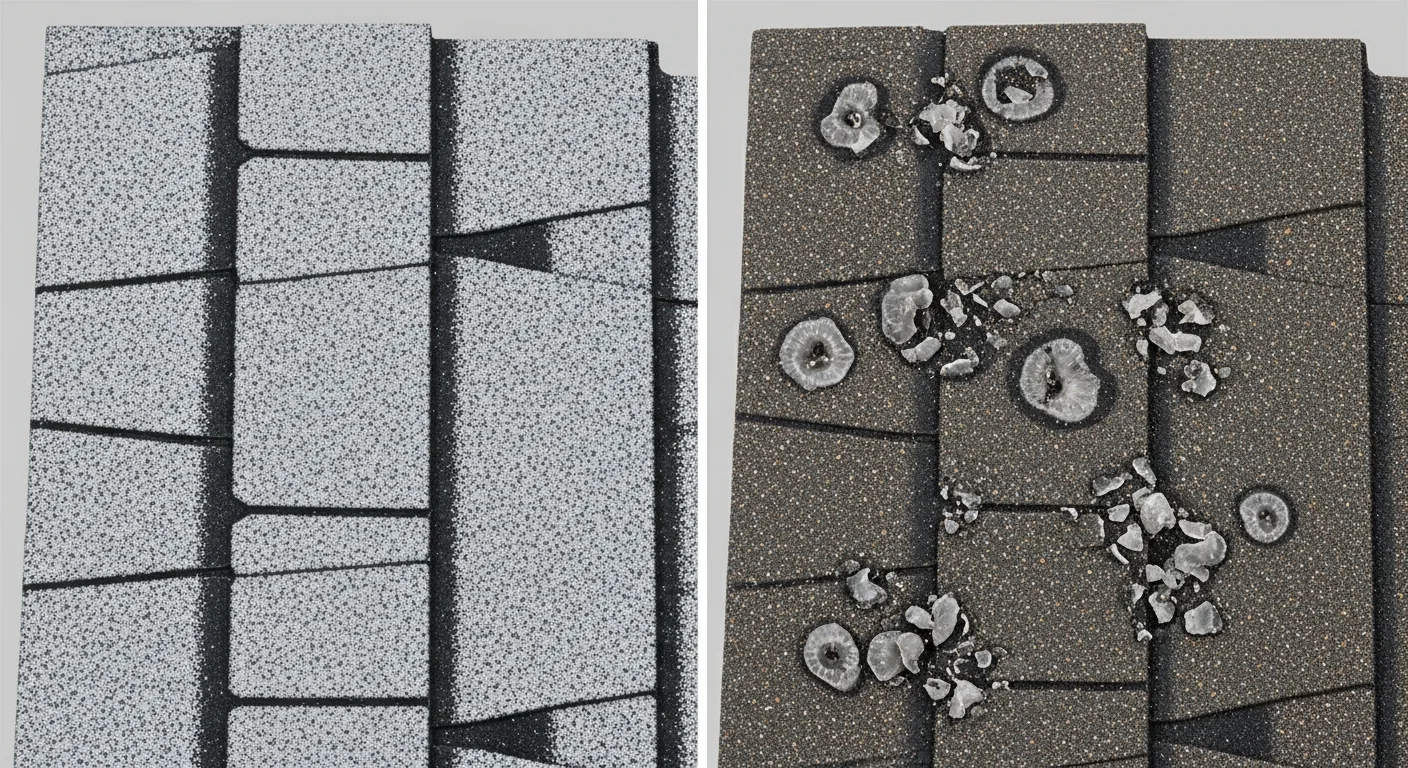

For composition shingles, adjusters count the number of damaged shingles per "test square" (a 10x10 foot area). They examine granule loss patterns, bruising depth, and whether impact damage has compromised the shingle's waterproofing integrity. Metal roofing evaluations focus on dent density, paint system damage, and whether impacts have affected the panel's structural performance.

Age and condition factor significantly into coverage decisions. Adjusters perform lifecycle cost analysis comparing repair costs against replacement value, considering the roof's remaining useful life. A 15-year-old roof system with extensive damage may qualify for full replacement, while newer systems might receive repair-only coverage.

Understanding these factors helps property owners present their case effectively. Professional documentation from experienced contractors can provide the technical evidence adjusters need to approve comprehensive coverage. Our hail and wind damage repair page details the specific documentation process that maximizes claim success.

Material and System Recommendations for Maximum Coverage

Insurance adjusters evaluate replacement recommendations based on like-kind-and-quality standards, but understanding material options can influence coverage outcomes. In the Texas Panhandle, certain roofing systems demonstrate superior performance against our specific climate challenges.

For residential applications, impact-resistant shingles rated Class 4 by UL Solutions often receive favorable consideration from adjusters. These systems show measurably better performance against hail damage and may qualify for insurance discounts. Metal roofing systems with proper impact ratings provide exceptional wind uplift resistance and thermal reflectivity benefits crucial for our climate.

Commercial evaluations focus heavily on membrane performance and seam integrity. Adjusters examine TPO, EPDM, and modified bitumen systems for punctures, splits, and thermal damage. They assess whether the existing system can maintain waterproof integrity given our extreme temperature cycling.

Energy efficiency considerations increasingly influence adjuster recommendations. Systems with high thermal reflectivity and proper R-value performance may receive enhanced coverage consideration, particularly when energy codes require upgraded performance standards.

Professional contractors familiar with adjuster expectations can recommend systems that maximize both performance and coverage outcomes. The key lies in presenting technical justification that aligns with insurance standards while addressing our region's unique environmental demands.

What to Expect During the Professional Evaluation Process

The insurance adjustment process follows a structured sequence that property owners should understand to ensure optimal outcomes. Initial contact typically occurs within 24-48 hours of claim filing, with physical inspection scheduled within 5-7 business days in normal circumstances.

During the evaluation, adjusters conduct comprehensive documentation including photographic evidence, damage measurements, and material sampling. They examine not only visible damage but also test for hidden issues like moisture intrusion and structural compromise. Advanced adjusters may use thermal imaging to detect temperature differentials indicating insulation damage or water penetration.

The process includes detailed assessment of collateral damage to gutters, downspouts, HVAC equipment, and exterior fixtures. In commercial evaluations, adjusters examine rooftop equipment, skylights, and penetration details that could contribute to overall claim value.

Property owners should prepare by gathering maintenance records, previous inspection reports, and photographs showing pre-storm conditions. This documentation helps establish the damage timeline and supports claim validity.

Professional roofing contractors can provide invaluable support during this process. Experienced teams understand adjuster protocols and can identify damage patterns that untrained individuals might miss. They also provide immediate temporary repairs to prevent further damage while claims process.

Why Choosing the Right Contractor Matters for Insurance Claims

The contractor you select for insurance work directly impacts both claim approval success and final project quality. Insurance adjusters work regularly with established roofing professionals who understand proper documentation, code compliance, and quality standards that satisfy carrier requirements.

Experienced contractors provide detailed damage assessments that complement adjuster findings, often identifying additional damage that supports comprehensive coverage. They understand the technical language adjusters use and can communicate effectively about membrane performance, wind uplift ratings, and thermal efficiency requirements.

Proper licensing and insurance coverage are non-negotiable factors. Adjusters verify contractor credentials and may deny coverage if work is performed by unlicensed operators. Established contractors maintain relationships with material suppliers that ensure appropriate product selection and availability.

Quality installation directly affects warranty coverage and future insurability. Poor workmanship can void manufacturer warranties and create liability issues that impact future claims. Professional installation following manufacturer specifications and local codes protects both immediate coverage and long-term property value.

Local expertise proves invaluable for Texas Panhandle conditions. Contractors familiar with our specific climate challenges understand which systems perform best and can recommend solutions that adjusters recognize as appropriate for our environment. Our commercial roofing services page details the comprehensive approach professional contractors bring to insurance work.

Don't let insurance complexities delay critical roof repairs. Contact CRS Roofing & Construction today for professional damage assessment and insurance claim support. Our experienced team understands exactly what adjusters look for and can guide you through every step of the process. With severe weather season approaching, protect your investment with expert evaluation and proven results. Call now to schedule your comprehensive roof inspection and take the first step toward complete coverage and peace of mind.

The Texas Panhandle's extreme weather conditions demand roofing systems that meet rigorous performance standards. Insurance adjusters pay particular attention to wind resistance ratings, which must comply with International Building Code (ICC) requirements for high-wind zones. In Amarillo's climate zone, asphalt shingles must demonstrate Class A fire resistance and wind uplift ratings of at least 110 mph, while metal roofing systems require structural attachment capable of withstanding uplift pressures exceeding 60 pounds per square foot.

When evaluating hail damage, adjusters look for specific impact patterns that correlate with National Severe Storms Laboratory data on regional storm intensity. Hailstones larger than 1.25 inches create distinctive granule displacement patterns on composition shingles and denting on metal panels that trained adjusters can distinguish from normal weathering. The Insurance Information Institute reports that Texas leads the nation in hail damage claims, making accurate damage assessment critical for property owners in our region.

Advanced roofing materials designed for severe weather zones receive closer scrutiny during evaluations. GAF Timberline series shingles feature StrikeZone technology that provides enhanced hail resistance, while impact-resistant products must meet UL 2218 Class 4 standards for maximum insurance discounts. Adjusters also examine cool roof technologies, as reflective coatings and materials that meet Cool Roof Rating Council standards can reduce thermal stress and extend system longevity in Texas heat.

Commercial roofing evaluations focus heavily on membrane integrity and attachment methods. Single-ply systems like TPO and EPDM must demonstrate proper seam welding and mechanical fastening according to manufacturer specifications. SPRI standards for wind uplift resistance become particularly relevant during adjustments, as improperly installed systems may void warranty coverage. Adjusters use specialized equipment to test membrane adhesion and identify areas where wind-driven moisture could compromise the building envelope, especially critical given our region's 40-degree temperature swings that create expansion and contraction stress.