When severe weather strikes the Texas Panhandle, homeowners and business owners face a critical window of opportunity to document damage and file insurance claims. Missing these deadlines can result in denied coverage, leaving you responsible for potentially thousands of dollars in roof repairs or replacement costs. Understanding your policy's specific timeframes and taking immediate action after storm events protects both your property and your financial interests.

Understanding Insurance Claim Deadlines and Policy Requirements

Insurance claim deadlines vary significantly depending on your specific policy, insurance carrier, and state regulations. Most standard homeowner's and commercial property insurance policies require notification of storm damage within one to two years of the incident, but many insurers impose much shorter deadlines for optimal claim processing and coverage approval.

The majority of insurance companies expect prompt notification—typically within 30 to 60 days of discovering damage to your building envelope. This "prompt notice" requirement exists because delayed reporting can complicate damage assessment, making it difficult for adjusters to distinguish between storm-related impact and normal roof system deterioration from weather exposure and aging materials.

Texas state law provides some protection for policyholders, requiring insurers to clearly communicate claim filing deadlines and providing minimum timeframes for coverage decisions. However, these legal protections don't override the practical benefits of filing claims quickly after storm events, particularly in areas prone to frequent severe weather like the Amarillo region.

Factors That Influence Claim Filing Deadlines

Several key factors determine how much time you have to file storm damage claims and the likelihood of successful coverage approval:

Policy Language and Carrier-Specific Requirements

Each insurance company establishes its own claim filing procedures and deadlines within state regulatory requirements. Some carriers require immediate notification within 24-48 hours of storm events, while others allow several months for damage discovery and reporting. Review your policy documents carefully, as these requirements are legally binding regardless of external circumstances.

Type and Severity of Storm Damage

Wind uplift damage, hail impact on impact-resistant shingles, and membrane punctures from flying debris often become apparent immediately after severe weather events. However, moisture intrusion through compromised flashing or damaged drainage systems may not manifest visible signs for weeks or months, complicating damage discovery timelines.

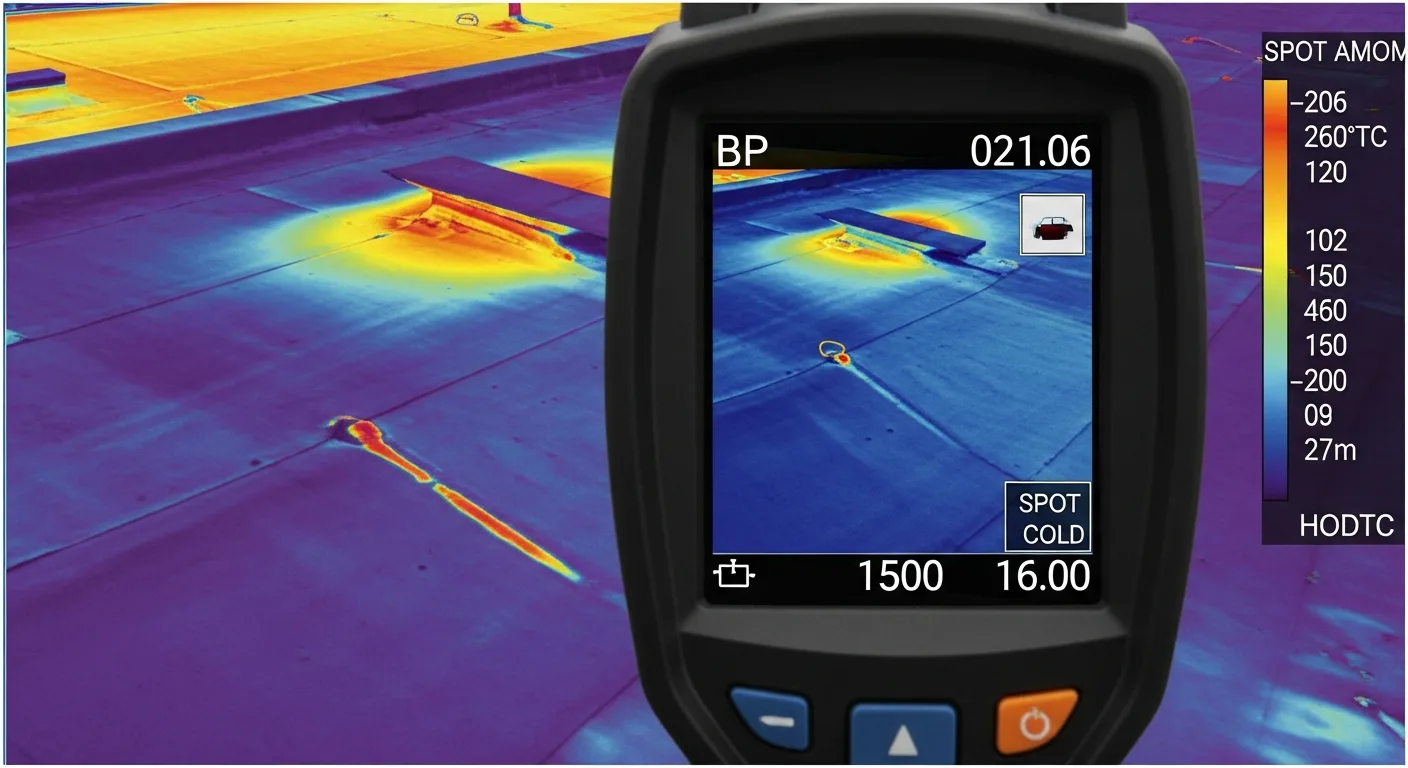

Insurance adjusters understand that certain types of building envelope damage—particularly those affecting commercial membrane systems like TPO, EPDM, or PVC roofing—may require professional inspection to identify and assess properly. This recognition can provide some flexibility in filing deadlines when damage isn't immediately obvious to property owners.

Documentation and Evidence Preservation

Weather patterns and subsequent storms can complicate damage attribution if claims are filed months after initial impact events. National Weather Service records help establish storm timing and severity, but physical evidence deteriorates over time, making prompt documentation crucial for successful claim resolution.

Best Practices for Timely Claim Filing

Protecting your coverage and maximizing claim approval probability requires systematic preparation and rapid response to storm events affecting your property.

Immediate Post-Storm Actions

Contact your insurance carrier within 24-48 hours of any significant weather event, even if damage isn't immediately apparent. This establishes a claim timeline and demonstrates your commitment to prompt notification requirements. Many insurers offer 24-hour claim reporting hotlines specifically for storm-related damage.

Document everything with photographs and detailed notes, focusing on:

- Visible roof damage including missing or damaged shingles, exposed underlayment, and compromised flashing

- Interior moisture intrusion signs such as water stains, ceiling discoloration, or active leaks

- Damaged gutters, downspouts, and other drainage system components

- Debris impact marks on roofing materials or building surfaces

Professional Inspection Coordination

Schedule professional roof inspection services immediately after storm events, regardless of whether damage is visible from ground level. Experienced roofing contractors can identify subtle damage to thermal barriers, membrane adhesion failures, and compromised wind uplift resistance that may not be apparent to untrained observers.

Professional documentation provides crucial evidence for insurance claims and helps establish damage timelines that support your filing. Learn more on our roof inspection services page for comprehensive damage assessment procedures.

Storm Damage Claims in High-Wind and Hail-Prone Areas

The Texas Panhandle's severe weather patterns create unique challenges for storm damage claims and insurance coverage. Understanding how local climate factors affect claim processing helps property owners navigate the system more effectively.

Frequent hailstorms in the Amarillo region mean insurance carriers are well-versed in identifying legitimate storm damage versus normal wear and tear. However, this familiarity also means adjusters scrutinize claims carefully, making thorough documentation and prompt filing even more critical for coverage approval.

High winds exceeding design specifications can cause granule loss on asphalt shingles, membrane lifting on commercial roofs, and fastener failure throughout roof systems. These damage types often worsen over time if not addressed promptly, making early detection and claim filing essential for preventing secondary damage that might not be covered under your policy.

The Insurance Institute for Business & Home Safety provides extensive research on storm damage patterns and building envelope performance that can support your claim documentation when professional assessment identifies specific failure modes consistent with documented weather events.

Multiple Storm Events and Claim Complexity

Properties in storm-prone areas often experience multiple weather events within short timeframes, complicating damage attribution and claim processing. Filing separate claims for distinct storm events, even if damage appears cumulative, helps ensure appropriate coverage for all qualifying damage.

Maintain detailed records of all weather events affecting your property, including dates, severity, and any visible damage noticed after each incident. This documentation becomes invaluable when working with adjusters to establish damage timelines and coverage eligibility.

When to Call a Professional Roofing Contractor

Professional roofing expertise becomes essential immediately after any significant weather event, regardless of whether damage is visible from ground level. Experienced contractors understand insurance requirements, documentation standards, and the technical aspects of roof system performance that influence claim outcomes.

Contact roofing professionals before filing insurance claims when possible, as their assessment can identify damage you might miss and provide the technical documentation that supports successful claim resolution. Professional contractors also understand warranty requirements and can recommend repair approaches that maintain coverage while addressing storm damage effectively.

Emergency tarping and temporary repairs may be necessary to prevent secondary damage from moisture intrusion, but coordinate these activities with your insurance carrier to ensure they don't compromise your claim. Many policies cover reasonable emergency measures to prevent additional damage while claims are processed.

Visit our hail and wind damage repair page to understand how professional assessment and repair services protect both your property and your insurance interests. Our team works directly with insurance adjusters to ensure comprehensive damage documentation and appropriate coverage for all qualifying repairs.

Don't let claim filing deadlines jeopardize your coverage when storm damage affects your property. Contact CRS Roofing & Construction immediately after severe weather events for professional damage assessment and insurance claim support throughout the Texas Panhandle region.

The Texas Panhandle's unique climate conditions create specific challenges for storm damage documentation and insurance claims. According to National Severe Storms Laboratory research, this region experiences some of the most intense hail storms in the United States, with hailstones frequently exceeding 2 inches in diameter. These extreme weather events can cause immediate visible damage as well as compromised roof system integrity that may not become apparent until subsequent weather exposure occurs.

When documenting hail damage for insurance claims, it's crucial to understand impact resistance ratings and material specifications. For example, GAF's Timberline HD shingles carry a Class 4 impact resistance rating, the highest available under UL 2218 testing standards. However, even impact-resistant materials can sustain damage from the severe hail events common in Amarillo and surrounding areas. Professional documentation should include granule loss patterns, exposed mat areas, and any compromise to the shingle's protective envelope that could lead to water infiltration.

The Insurance Information Institute emphasizes that Texas property owners should be particularly vigilant about wind damage documentation, as the Panhandle regularly experiences sustained winds exceeding 60 mph during storm events. High winds can cause shingle lifting, exposed fasteners, and membrane punctures that may not be immediately visible from ground level. Professional roof inspections using industry-standard protocols help ensure comprehensive damage assessment that supports successful insurance claims.

For commercial properties, documentation becomes even more critical due to the complexity of membrane systems and potential business interruption costs. NRCA guidelines recommend immediate temporary protective measures following storm events, which not only prevent additional damage but also demonstrate due diligence to insurance carriers. This is particularly important for TPO and EPDM membrane systems commonly used on commercial buildings throughout the Texas Panhandle, where thermal cycling and UV exposure can compound storm-related damage over time.

Energy efficiency considerations also play a role in storm damage claims, especially when roof system compromise affects building envelope performance. The extreme temperature variations in the Texas Panhandle—from summer highs exceeding 100°F to winter lows below freezing—place significant stress on roofing materials. Department of Energy studies show that damaged roof systems can reduce energy efficiency by 15-25%, creating additional financial impacts that should be documented as part of comprehensive insurance claims.

Understanding these technical aspects and regional climate factors helps property owners work more effectively with insurance adjusters and roofing professionals to ensure complete damage assessment and appropriate claim settlements. The combination of extreme weather exposure and strict filing deadlines makes professional documentation and prompt action essential for protecting your investment in the challenging Texas Panhandle environment.