Filing a roof insurance claim in the Texas Panhandle often feels like a double-edged sword—you need coverage for storm damage, but worry about premium increases that could impact your budget for years. Understanding how insurers evaluate claims and adjust rates helps you make informed decisions about protecting your home's building envelope while managing long-term costs.

How Insurance Claims Actually Affect Your Premiums

The relationship between roof claims and premium increases isn't as straightforward as many homeowners assume. Insurance companies use complex algorithms that consider multiple factors beyond just claim frequency. Your premiums may increase, but the impact depends on several key variables that work together to determine your risk profile.

Most insurers distinguish between weather-related claims and those resulting from negligence or poor maintenance. A hail damage claim after a severe Texas Panhandle storm typically carries less weight than claims for preventable issues like moisture intrusion from deferred roof maintenance. This distinction becomes crucial when insurers evaluate your long-term risk and adjust rates accordingly.

The timing and frequency of claims significantly influence premium adjustments. A single weather-related claim within a five-year period usually has minimal impact, while multiple claims—even for legitimate storm damage—can trigger more substantial rate increases. Insurance industry data shows that claim frequency is often more influential than claim size when insurers calculate risk.

Key Factors That Determine Premium Changes

Several critical factors influence whether and how much your premiums increase after a roof claim. Understanding these elements helps you anticipate potential costs and make strategic decisions about when to file claims.

Claim Amount and Deductible Relationship

The size of your claim relative to your deductible plays a significant role in premium calculations. Small claims that barely exceed your deductible often have disproportionate impacts on future rates compared to their immediate benefit. For instance, filing a $3,000 claim with a $2,500 deductible might increase your premiums more than the $500 you receive, making it financially disadvantageous over time.

Larger claims for significant storm damage—such as complete roof system replacement after hail damage—typically have less impact per dollar of coverage. These claims demonstrate the insurance working as intended rather than suggesting elevated risk from poor maintenance or minor issues.

Your Claims History and Regional Risk Factors

Insurers maintain detailed records of your claims history, typically looking back five to seven years when calculating rates. They also consider regional risk factors, which makes the Texas Panhandle's severe weather patterns particularly relevant. Areas with frequent hailstorms and high winds naturally have higher base rates, but this also means weather-related claims are more expected and less likely to trigger dramatic increases.

Your home's age, roof system lifespan, and previous maintenance records also influence how insurers view claims. A well-documented history of regular inspections and maintenance can help demonstrate that claims result from unavoidable weather events rather than negligence.

Insurance Company Policies and Market Conditions

Different insurers have varying approaches to post-claim rate adjustments. Some companies offer "claim-free discounts" that you lose after filing any claim, while others focus primarily on fault-based incidents. Market conditions, reinsurance costs, and regional claim volumes also influence how aggressively companies adjust rates after claims.

During periods of widespread storm damage—common in the Texas Panhandle—insurers may be less likely to penalize individual claims since they're part of larger weather events affecting entire regions. Conversely, isolated claims during calm periods might receive more scrutiny.

Strategies to Minimize Premium Impact

While you cannot completely control premium adjustments, several strategies can help minimize increases while ensuring your roof system receives necessary repairs and maintenance.

Document Everything Thoroughly

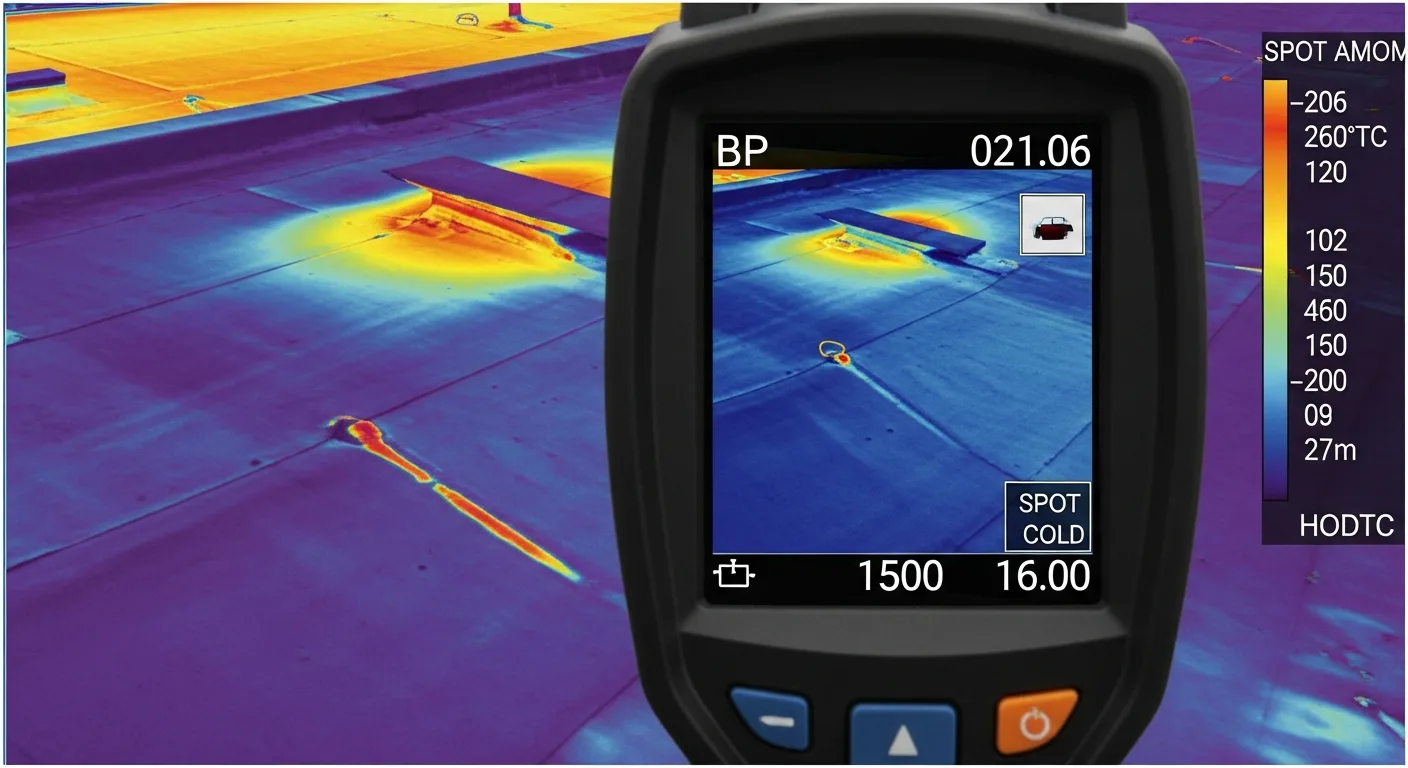

Comprehensive documentation of storm damage, maintenance history, and repair quality helps establish legitimate claims that insurers are less likely to penalize heavily. Professional inspections, photographs of damage, and detailed repair records create a clear narrative that weather events caused the damage rather than negligence or normal wear.

Consider having regular inspections performed by qualified contractors who can document your roof's condition before and after storms. This proactive approach demonstrates responsible ownership and can support future claims if severe weather damages well-maintained roofing systems.

Strategic Claim Timing and Bundling

When multiple issues arise from the same storm event, file a single comprehensive claim rather than multiple separate claims. Bundling hail damage repairs with wind damage or gutter replacement presents one incident rather than multiple claim events that could compound premium impacts.

Timing also matters when dealing with minor damage that doesn't require immediate attention. If you anticipate potential storm damage in the near future, consider whether waiting might allow you to bundle minor issues with more substantial weather-related repairs under a single claim.

Invest in Impact-Resistant Materials

Upgrading to impact-resistant shingles, enhanced wind uplift resistance, or other storm-resistant features can help offset premium increases through discounts for protective measures. Many insurers offer reduced rates for roofs that meet specific wind and hail resistance standards, which can help balance post-claim adjustments.

These upgrades also reduce the likelihood of future claims, creating long-term savings that often exceed the initial investment. In high-wind areas like the Texas Panhandle, improved wind uplift resistance can significantly reduce storm damage risk.

Special Considerations for Storm-Prone Areas

The Texas Panhandle's severe weather patterns create unique considerations for insurance claims and premium impacts. Understanding how insurers view regional risk factors helps homeowners make better decisions about coverage and claims.

Insurers expect higher claim frequencies in areas with regular hailstorms and extreme weather. This expectation can work in your favor when filing legitimate weather-related claims, as they're considered normal for the region rather than exceptional risk factors. However, it also means base premiums are typically higher to account for expected claim activity.

The region's extreme temperature fluctuations and UV exposure contribute to normal roof system aging, which insurers factor into their risk calculations. Claims for damage clearly attributable to severe weather events are generally viewed more favorably than those that might involve normal wear acceleration.

Research from the Insurance Institute for Business & Home Safety shows that proactive maintenance and storm-resistant features significantly reduce claim frequencies in high-risk areas, leading to better long-term premium stability.

When to Call a Professional Roofer

Professional evaluation becomes crucial both before filing claims and when considering whether minor damage justifies a claim filing. Experienced contractors can assess whether damage requires immediate attention or can wait, helping you make strategic decisions about claim timing.

A thorough professional inspection after severe weather can identify all storm-related damage, ensuring comprehensive claims that address all issues in a single filing rather than discovering additional problems later that might require separate claims.

Professional contractors also understand insurance requirements and can provide documentation that supports your claim while demonstrating the damage resulted from covered weather events rather than maintenance issues. This expertise proves invaluable when dealing with claim adjusters and can influence how insurers view the claim's legitimacy.

If you're concerned about potential premium increases after storm damage, visit our roof inspection services page to schedule a professional evaluation. Our experienced team can assess damage severity, help document weather-related issues, and provide guidance on the best approach for protecting both your home and your insurance rates. Don't let worry about premium increases prevent you from maintaining your roof system's integrity—proper professional guidance ensures you make informed decisions that protect your investment long-term.

The Texas Panhandle's extreme weather patterns create unique challenges for homeowners navigating insurance claims and premium considerations. According to National Severe Storms Laboratory research, our region experiences some of the most severe hail events in the United States, with storms producing hailstones exceeding 2 inches in diameter becoming increasingly common. This frequency of severe weather events has led many Texas insurers to implement specific underwriting guidelines for Panhandle properties.

When evaluating roof damage claims, insurance adjusters specifically look for impact-resistant roofing materials that meet ASTM D3161 and D7158 testing standards for wind and impact resistance. Installing Class 4 impact-resistant shingles, such as those offered by manufacturers like TAMKO's Heritage series, can actually help mitigate future premium increases by demonstrating proactive risk reduction measures to your insurer.

The Insurance Institute for Business & Home Safety (IBHS) FORTIFIED program has become increasingly relevant for Texas Panhandle homeowners seeking to minimize both storm damage and insurance rate impacts. Properties meeting FORTIFIED standards, which include enhanced roof deck attachment, sealed roof deck, and impact-resistant covering systems, often qualify for insurance discounts that can offset potential rate increases from previous claims.

Understanding your policy's specific language around "acts of nature" versus maintenance-related damage becomes crucial in our climate. The Insurance Information Institute notes that Texas homeowners filing weather-related claims within industry-recognized storm dates typically face different rate adjustment calculations than those filing for wear-and-tear issues. Proper documentation of routine maintenance, including professional inspections after severe weather events, can significantly influence how insurers categorize and price future coverage adjustments.