When severe weather strikes the Texas Panhandle, homeowners face the daunting task of assessing roof damage and navigating insurance claims. Understanding what your homeowner's insurance policy actually covers—and what it doesn't—can mean the difference between a successful claim and unexpected out-of-pocket expenses. With the region's frequent hailstorms, high winds, and extreme weather events, knowing your coverage details becomes crucial for protecting your investment.

What Roof Damage Insurance Typically Covers

Most standard homeowner's insurance policies provide coverage for sudden and accidental roof damage caused by specific perils. Understanding these covered events helps homeowners recognize when they have a legitimate claim and when they should contact their insurance company.

Storm-Related Damage

The most commonly covered roof damage stems from severe weather events. Wind damage from storms, including wind uplift that tears off shingles or damages the roof system, typically falls under standard coverage. The Insurance Institute for Business & Home Safety notes that wind speeds as low as 45 mph can begin lifting shingle edges, making this a frequent claim type in the Texas Panhandle.

Hail damage represents another major category of covered losses. Impact-resistant shingles may reduce damage severity, but when hail exceeds the rated impact resistance, insurance typically covers the resulting roof system damage. This includes granule loss, cracked or punctured shingles, and damage to flashing and gutters.

Fire and Lightning Damage

Fire damage, whether from external sources or lightning strikes, generally receives full coverage under standard policies. This includes not only direct fire damage but also smoke damage to roofing materials and the building envelope. Lightning strikes can cause immediate roof damage or create conditions leading to moisture intrusion over time.

Falling Objects and Impact Damage

When trees, branches, or other objects fall onto your roof, causing sudden damage, insurance typically covers the repairs. However, the circumstances matter significantly—a healthy tree falling due to storm winds usually qualifies for coverage, while a diseased tree that homeowners neglected to remove may face coverage challenges.

Common Coverage Limitations and Exclusions

Understanding what insurance doesn't cover proves equally important for homeowners planning roof maintenance and budgeting for potential expenses.

Wear and Tear Exclusions

Insurance policies consistently exclude coverage for normal wear and tear, gradual deterioration, and maintenance-related issues. A roof system reaching the end of its expected lifespan won't qualify for replacement coverage simply due to age. This exclusion emphasizes the importance of regular roof inspections and proactive maintenance.

Pre-Existing Damage

Damage that existed before the policy effective date or before a covered event typically receives no coverage. Insurance adjusters often scrutinize claims carefully to distinguish between new storm damage and pre-existing conditions, making documentation of your roof's condition valuable.

Flood-Related Damage

Standard homeowner's policies exclude flood damage, which requires separate flood insurance. However, the distinction between wind-driven rain (typically covered) and flood damage can create gray areas that require careful evaluation during the claims process.

Actual Cash Value vs. Replacement Cost Coverage

The type of coverage in your policy significantly affects your claim settlement amount and out-of-pocket expenses.

Replacement Cost Coverage

Replacement cost coverage pays to repair or replace your roof with materials of similar quality without deducting for depreciation. This coverage type typically results in higher claim payments but comes with higher premium costs. For newer roofs or high-quality roofing systems, replacement cost coverage often provides better value.

Actual Cash Value Coverage

Actual cash value coverage factors in depreciation based on the roof's age and condition. While premiums cost less, claim settlements may leave homeowners with significant out-of-pocket expenses, especially for older roofing systems. The National Roofing Contractors Association recommends understanding your policy type before damage occurs.

Maximizing Your Coverage in High-Wind and Hail-Prone Areas

Living in the Texas Panhandle requires strategic thinking about roof insurance coverage due to the region's severe weather patterns.

Impact-Resistant Materials and Discounts

Many insurance companies offer premium discounts for installing impact-resistant shingles rated for Class 3 or Class 4 hail resistance. These materials not only reduce damage likelihood but may also result in lower deductibles for hail claims. When considering roof replacement, explore our residential roofing service page to learn about impact-resistant options suitable for severe weather climates.

Wind Resistance Considerations

Proper installation techniques and wind-resistant materials can affect both damage susceptibility and insurance coverage. Roofing systems installed to higher wind resistance standards may qualify for coverage benefits and reduce the likelihood of wind uplift damage during storms.

Documentation and Maintenance Records

Maintaining detailed records of roof maintenance, inspections, and previous repairs strengthens your position during claims. Regular professional inspections can identify and address minor issues before they compromise your coverage eligibility. Visit our roof inspection services section to understand how professional documentation supports insurance claims.

The Claims Process and Professional Assessment

Successfully navigating roof insurance claims requires understanding the process and knowing when professional help becomes essential.

Initial Damage Assessment

After suspected damage occurs, document the damage with photographs and contact your insurance company promptly. However, avoid making temporary repairs beyond preventing further damage, as premature repairs can complicate the adjustment process.

Professional Inspection Benefits

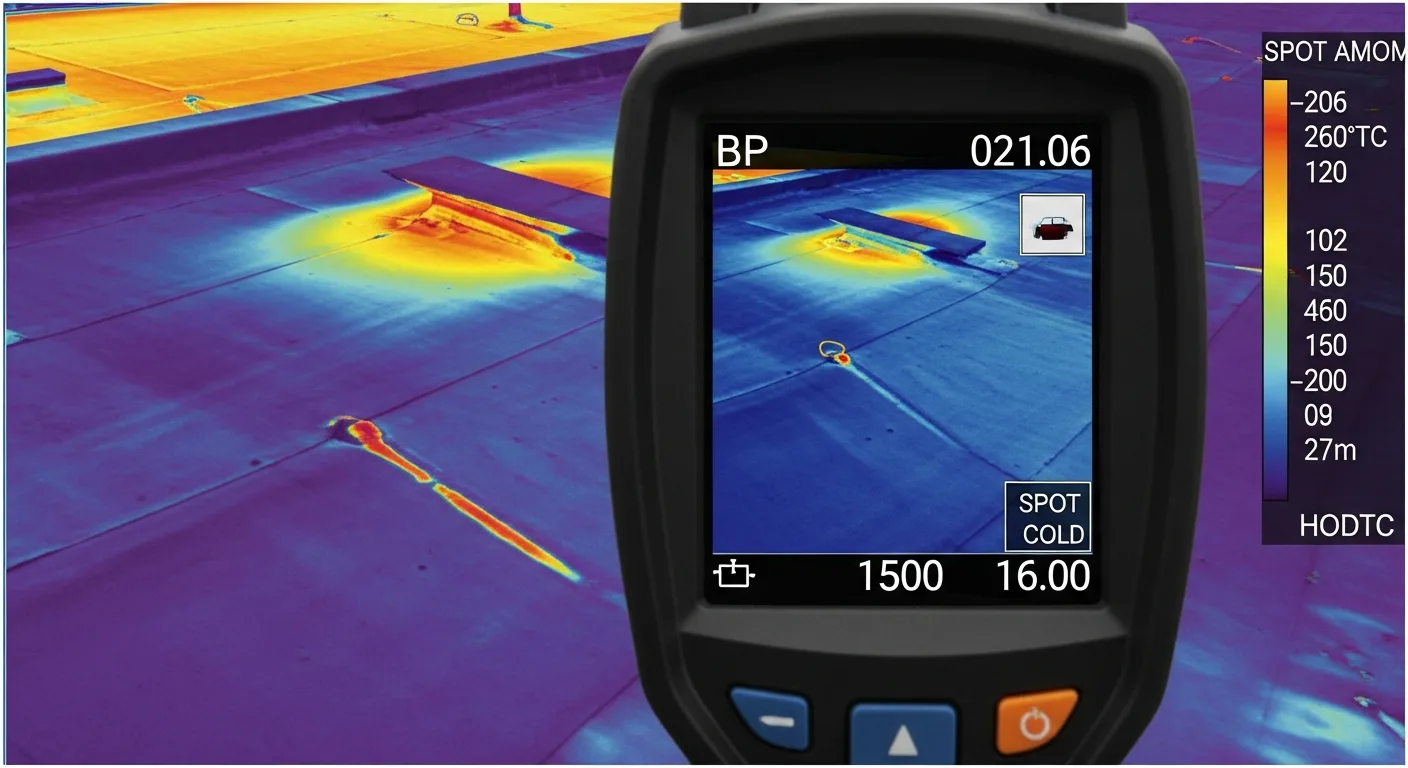

Professional roofing contractors trained in insurance restoration can identify damage that property owners might miss. Hidden damage to flashing, underlayment, or the building envelope may not be immediately apparent but affects the roof system's integrity and warranty requirements.

Insurance adjusters evaluate claims based on industry standards and manufacturer specifications. Having a professional assessment ensures all damage gets properly documented and included in the claim scope.

When to Call a Professional Roofer

Certain situations require professional expertise to protect both your property and insurance interests. Contact a qualified roofing contractor when you notice missing or damaged shingles, signs of moisture intrusion, or after any severe weather event that may have compromised your roof system.

For storm damage assessment, see our hail and wind damage repair page to understand how professional evaluation can identify both visible and hidden damage that affects your insurance claim. Professional contractors familiar with local weather patterns and insurance requirements can guide you through the claims process while ensuring proper repairs that maintain your roof system's integrity and warranty coverage.

Understanding your insurance coverage before you need it helps you make informed decisions about materials, maintenance, and claims. In the storm-prone Texas Panhandle, this knowledge proves invaluable for protecting your home and maximizing your insurance investment.

Impact-resistant shingles have become increasingly important for Texas Panhandle homeowners, where hailstorms frequently produce stones exceeding 2 inches in diameter. The Insurance Institute for Business & Home Safety (IBHS) has established rigorous testing standards for impact resistance, with Class 4 shingles offering the highest level of protection. These specialized shingles undergo testing with steel balls dropped from heights of 12 to 20 feet, simulating hail impacts that commonly occur during severe Texas storms.

When evaluating roof damage for insurance purposes, understanding the specific wind and impact ratings becomes crucial. GAF's Timberline HD shingles, for example, are engineered to withstand winds up to 130 mph when properly installed, which is particularly relevant given that the Texas Panhandle experiences some of the nation's strongest straight-line winds. The region's unique climate challenges, including temperature swings from below freezing in winter to over 100°F in summer, create thermal cycling that can accelerate normal wear and tear on roofing materials.

Fire resistance ratings also factor into insurance coverage and premiums, especially important given the dry conditions common in the Texas Panhandle. NFPA standards classify roofing materials into Class A, B, or C fire ratings, with Class A offering the highest level of fire resistance. Many insurance companies provide discounts for homes with Class A-rated roofing materials, recognizing the reduced risk of fire damage spreading through wind-blown embers during wildfire conditions.

The Insurance Information Institute reports that homeowners who proactively upgrade to impact-resistant roofing materials can see premium reductions of 10-30% in hail-prone areas. Additionally, building code compliance becomes critical for coverage, as many policies require that repairs and replacements meet current International Building Code (IBC) standards, even if the original roof was installed under older codes. This requirement can significantly impact the scope and cost of covered repairs.