When severe weather strikes the Texas Panhandle, homeowners often discover that their insurance claim approval depends on more than just storm damage. The age and maintenance history of your roof can significantly impact whether your claim gets approved or denied, leaving many property owners facing unexpected out-of-pocket expenses for repairs or replacement.

How Roof Age and Maintenance Impact Insurance Claims

Insurance companies evaluate roof claims based on the principle of "proximate cause" – determining whether storm damage or pre-existing conditions caused the need for repairs. While insurers cannot automatically deny claims solely based on roof age, they can deny coverage if they determine that poor maintenance or normal wear and tear, rather than covered perils like hail or wind, caused the damage.

Most insurance policies cover "sudden and accidental" damage from covered perils but exclude damage from neglect, normal wear and tear, or deterioration. This distinction becomes critical when adjusters inspect roofs that show signs of aging or inadequate maintenance alongside recent storm damage.

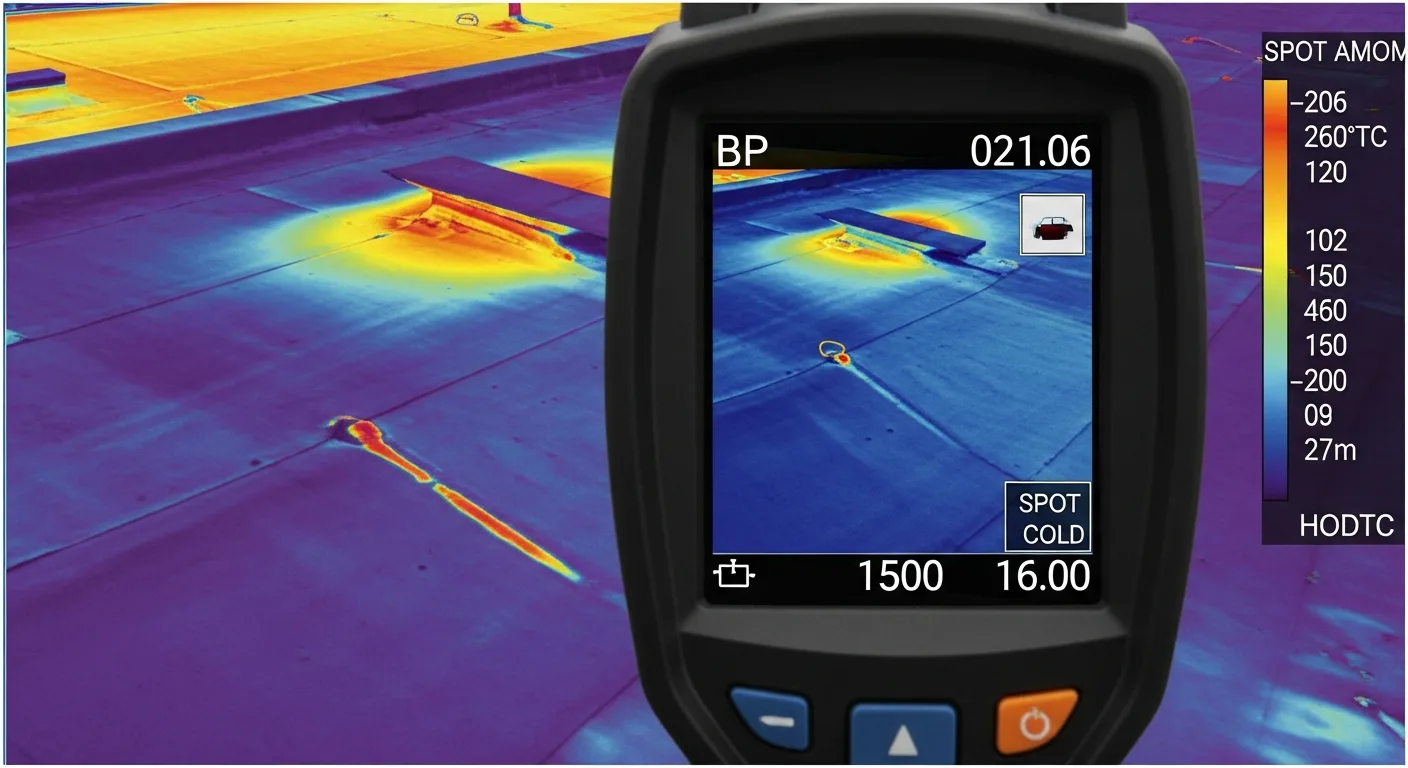

The building envelope's integrity plays a crucial role in these determinations. When moisture intrusion has occurred over time due to maintenance issues, insurers may argue that subsequent damage resulted from ongoing neglect rather than the recent storm event.

Key Factors Insurance Adjusters Evaluate

Insurance adjusters look for specific indicators when assessing whether damage stems from storm events or pre-existing conditions:

- Granule loss patterns: Recent hail damage creates distinct circular patterns, while normal aging shows uniform granule loss across large areas

- Shingle condition: Curling, cracking, or brittleness may indicate age-related deterioration rather than storm damage

- Flashing integrity: Corroded or improperly sealed flashing suggests maintenance issues that could have prevented moisture intrusion

- Gutters and drainage: Clogged or damaged drainage systems can indicate poor maintenance that contributed to water damage

- Previous repair quality: Substandard repairs may be viewed as contributing factors to current damage

According to the National Roofing Contractors Association, proper documentation of roof maintenance and timely repairs significantly strengthens insurance claims by demonstrating responsible property ownership.

Age-Related Considerations

While age alone cannot justify claim denial, older roofs face increased scrutiny. Roofs approaching the end of their expected roof system lifespan may have reduced wind uplift resistance or compromised impact-resistant capabilities, making it harder to distinguish between storm damage and normal deterioration.

Some insurers may apply depreciation based on the roof's age, reducing claim payouts even when damage is covered. Understanding your policy's replacement cost versus actual cash value coverage becomes crucial for older roofing systems.

Protecting Your Claim Eligibility Through Proper Maintenance

Proactive maintenance significantly improves claim approval chances and helps preserve your roof's warranty requirements. Key maintenance practices include:

Regular Professional Inspections

Annual inspections by qualified roofing professionals help identify and address minor issues before they become major problems. These inspections should document the roof's condition, creating a maintenance history that supports future insurance claims. Consider visiting our roof inspection services to establish this important documentation.

Prompt Repair of Minor Issues

Addressing small problems like loose shingles, minor flashing issues, or damaged sealants prevents minor issues from becoming major maintenance problems. The Insurance Institute for Business & Home Safety emphasizes that timely repairs demonstrate responsible property ownership and help maintain coverage eligibility.

Gutter and Drainage Maintenance

Proper drainage dynamics prevent ponding water and moisture intrusion that can compromise the building envelope. Regular gutter cleaning and downspout maintenance protect against water damage that insurers might attribute to neglect.

Documentation and Records

Maintaining detailed records of all maintenance, repairs, and inspections creates a paper trail that supports insurance claims. Include photographs, receipts, and professional assessments to demonstrate ongoing care of your roofing system.

Storm-Prone Areas and Enhanced Coverage Considerations

Texas Panhandle homeowners face unique challenges due to frequent severe weather events, including high winds, hailstorms, and extreme temperature fluctuations. These conditions require enhanced attention to maintenance and coverage considerations.

Impact-resistant shingles and improved wind uplift resistance can help maintain coverage eligibility while potentially qualifying for insurance discounts. Many insurers offer incentives for roofing materials that meet enhanced performance standards for high-wind areas.

After severe weather events, prompt professional assessment helps distinguish new storm damage from pre-existing conditions. Quick action also demonstrates due diligence in preventing further damage, which insurers appreciate when processing claims. Learn more on our hail and wind damage repair page for specific guidance on post-storm procedures.

UV Exposure and Thermal Cycling

The intense UV exposure and thermal cycling common in the Texas Panhandle accelerate roof aging. Understanding how these factors affect different roofing materials helps homeowners make informed maintenance decisions and prepare for insurance discussions about age-related wear.

Cool roof technologies and enhanced thermal reflectivity can reduce aging effects while potentially improving energy efficiency and insurance claim outcomes.

When Insurance Denies Your Claim

If your claim is denied due to age or maintenance concerns, you have several options:

- Request detailed explanation: Insurers must provide specific reasons for claim denials

- Obtain independent assessment: Professional roofing contractors can provide expert opinions distinguishing storm damage from wear

- Document storm damage: Photographs and professional assessments help support appeals

- Consider public adjusters: These professionals specialize in maximizing insurance claim outcomes

- Review policy language: Understanding coverage specifics helps identify potential grounds for appeal

The Federal Emergency Management Agency provides resources for understanding disaster-related insurance claims and homeowner rights during the claims process.

When to Call a Professional Roofer

Professional roofing contractors play crucial roles in maintaining claim eligibility and supporting successful insurance outcomes. Consider professional assistance when:

- Scheduling annual inspections to document roof condition

- Addressing maintenance issues before they compromise coverage

- Assessing storm damage and distinguishing it from pre-existing conditions

- Providing expert documentation for insurance claims

- Navigating complex claim disputes or appeals

Experienced roofing professionals understand insurance requirements and can help homeowners maintain their roofs in ways that support coverage eligibility. They can also provide detailed assessments that help distinguish between storm damage and normal wear when claims are disputed.

Don't let poor maintenance or documentation jeopardize your insurance coverage when you need it most. Visit our residential roofing services section to learn how professional maintenance and prompt repairs protect both your property and your insurance claim eligibility. Taking proactive steps today ensures you're prepared when severe weather strikes the Texas Panhandle.

Texas Panhandle homeowners face unique challenges when it comes to roof maintenance and insurance claims due to the region's extreme weather conditions. The area experiences frequent hailstorms, high winds exceeding 70 mph, and temperature swings that can range from over 100°F in summer to below freezing in winter. These conditions accelerate normal wear and tear, making proper maintenance documentation even more critical for successful insurance claims.

According to NOAA weather data, the Texas Panhandle receives some of the most severe hail activity in the United States, with "Hail Alley" producing golf ball-sized hail multiple times per year. This frequent impact testing means that shingles rated for Class 4 impact resistance, such as those meeting ASTM D3462 standards, perform significantly better in claim approvals when proper installation and maintenance can be documented.

Insurance adjusters specifically look for compliance with manufacturer maintenance requirements when evaluating claims. For instance, GAF's Timberline warranty requirements include annual inspections and prompt repair of minor issues – documentation that can be crucial in defending against maintenance-related claim denials. The National Roofing Contractors Association recommends bi-annual professional inspections, particularly after severe weather events common in the Texas Panhandle.

Building envelope performance becomes particularly important in Texas's extreme climate conditions. The Insurance Institute for Business & Home Safety's FORTIFIED standards emphasize that proper installation and maintenance of sealed roof decks and secondary water barriers can prevent the moisture intrusion issues that often lead to claim denials. When adjusters find evidence of ongoing water damage from maintenance neglect, they can successfully argue that storm damage was secondary to pre-existing conditions, even when recent hail damage is clearly visible.

For Texas homeowners, maintaining detailed records becomes essential given the frequency of severe weather events. Professional inspections following IIBEC building envelope assessment protocols can provide the documentation needed to demonstrate that your roof was properly maintained before storm damage occurred, significantly improving the likelihood of claim approval regardless of your roof's age.