Texas homeowners face some of the most severe weather conditions in the country, with hailstorms, tornadoes, and high winds capable of causing significant roof damage in a matter of minutes. When your roof sustains storm damage, navigating the insurance claim process can feel overwhelming, but understanding the proper steps can make the difference between a smooth claim resolution and months of frustration. This comprehensive guide will help you maximize your insurance settlement and ensure your roof replacement is handled professionally and efficiently.

Understanding Your Insurance Policy Before Storm Season

Before severe weather strikes, it's crucial to understand the specifics of your homeowner's insurance policy. Most standard policies cover sudden and accidental damage from storms, including hail, wind, and tornado damage, but the details matter significantly. Review your policy's deductible, coverage limits, and any exclusions that might apply to roof damage. Some policies have separate wind and hail deductibles, which can be higher than your standard deductible.

Pay particular attention to your policy's replacement cost coverage versus actual cash value coverage. Replacement cost coverage pays for repairs or replacement at current market prices, while actual cash value factors in depreciation, potentially leaving you with a significant out-of-pocket expense. The Federal Emergency Management Agency recommends reviewing your policy annually and updating coverage as needed to ensure adequate protection.

Document your roof's condition before storm season arrives. Take clear photographs from multiple angles, including close-ups of the roofing materials, gutters, and any existing issues. This pre-storm documentation can be invaluable when filing a claim, as it establishes the roof's condition before the damage occurred.

Immediate Steps After Storm Damage Occurs

Safety should be your first priority after a severe storm. Do not attempt to climb on your roof or make repairs until you're certain it's safe to do so. If you suspect structural damage or notice any immediate hazards like exposed electrical wires or gas leaks, evacuate the area and contact emergency services immediately.

Once it's safe, begin documenting the damage thoroughly. Take extensive photographs and videos of all visible damage, including the roof, gutters, siding, windows, and interior damage from potential leaks. The Insurance Institute for Business & Home Safety recommends photographing damage from multiple angles and distances to provide comprehensive evidence for your claim.

Contact your insurance company as soon as possible to report the claim. Most insurers have 24-hour claim reporting hotlines, and prompt reporting can help expedite the process. Be prepared to provide basic information about the storm date, type of damage observed, and whether you need emergency repairs to prevent further damage.

If immediate temporary repairs are necessary to prevent additional damage, such as covering exposed areas with tarps, keep all receipts and document the work performed. Most insurance policies cover reasonable emergency repairs, but always check with your adjuster before proceeding with anything beyond basic protective measures.

Professional Roof Inspection and Assessment

While you may notice obvious damage like missing shingles or dented gutters, storm damage often includes less visible issues that require professional assessment. Hail and wind damage can compromise your roof's integrity in ways that aren't immediately apparent to untrained eyes, such as cracked or loosened shingles, damaged underlayment, or compromised flashing.

Schedule a professional roof inspection with a reputable local contractor who understands Texas weather patterns and insurance requirements. At CRS Roofing & Construction, we offer free storm damage assessments to help homeowners identify all potential issues before meeting with insurance adjusters. A thorough professional inspection often reveals damage that homeowners miss, ensuring your claim covers all necessary repairs.

Working Effectively with Insurance Adjusters

Your insurance company will assign an adjuster to evaluate your claim and determine coverage. Prepare for this meeting by organizing all your documentation, including photos, videos, receipts for emergency repairs, and your professional inspection report. Be present during the adjuster's inspection to point out all damage areas and ask questions about their assessment process.

Insurance adjusters are trained to evaluate damage, but they may not always catch everything, especially subtle hail damage or wind damage that affects the roof's long-term performance. Having a professional contractor present during the inspection can be beneficial, as they can point out technical issues that might be overlooked and explain how seemingly minor damage could lead to future problems.

Don't feel pressured to accept the first settlement offer if you believe it's insufficient. You have the right to request a re-inspection or obtain a second opinion. The National Roofing Contractors Association provides resources on understanding roof damage and working with insurance companies to ensure fair settlements.

Keep detailed records of all communications with your insurance company, including dates, names of representatives, and summaries of conversations. This documentation can be valuable if disputes arise later in the process.

Understanding Common Coverage Issues

Several common issues can complicate roof insurance claims in Texas. Age-related wear and maintenance issues are typically not covered, so adjusters may attribute some damage to normal aging rather than storm damage. Pre-existing conditions, even minor ones, can also affect coverage decisions.

Matching existing roofing materials can present challenges, especially with older roofs. If your damaged shingles are no longer manufactured or available in the same color, your policy should cover upgrading the entire roof section to maintain uniformity, but this isn't always automatically included in initial estimates.

Choosing the Right Contractor for Insurance Work

Selecting a qualified contractor experienced in insurance claims is crucial for a successful roof replacement project. Look for contractors who are licensed, bonded, and insured, with specific experience handling insurance claims in your area. Avoid door-to-door contractors who appear immediately after storms, as these "storm chasers" often provide poor workmanship and may disappear before completing the job.

Research potential contractors thoroughly, checking references, online reviews, and Better Business Bureau ratings. Verify that they're authorized dealers for major manufacturers like GAF or Owens Corning, which often indicates higher quality standards and access to comprehensive warranty programs.

A reputable contractor should provide a detailed written estimate that matches or exceeds your insurance settlement. They should also be willing to work directly with your insurance company and handle any additional documentation or negotiations needed to ensure proper coverage for all necessary work.

When considering roof replacement options, discuss material choices that meet both insurance requirements and local building codes. Some insurance companies offer discounts for impact-resistant shingles or other storm-resistant materials, which can provide long-term savings and protection.

Energy Efficiency Considerations

If you're replacing your entire roof due to storm damage, consider upgrading to more energy-efficient materials and systems. The Department of Energy provides information on roofing materials and installation techniques that can significantly reduce energy costs in Texas's hot climate.

While insurance may only cover basic replacement costs, investing in energy-efficient upgrades like reflective shingles, improved ventilation, or enhanced insulation can provide long-term benefits. Some utilities offer rebates for energy-efficient roofing materials, and federal tax credits may be available for certain qualifying improvements.

Avoiding Common Claim Mistakes

Several common mistakes can jeopardize your insurance claim or reduce your settlement. Delaying claim reporting is one of the most significant errors, as insurance companies may question whether damage occurred during the reported storm if too much time passes. Most policies require prompt notification of claims.

Don't make permanent repairs before the adjuster's inspection unless absolutely necessary to prevent further damage. Removing damaged materials before documentation can eliminate evidence needed to support your claim. If emergency repairs are necessary, photograph everything before and after the work.

Avoid accepting settlements that seem too low without obtaining professional estimates. Insurance companies sometimes provide initial estimates that cover only the most obvious damage, requiring supplemental claims for additional issues discovered during the repair process.

Finally, don't sign any agreements with contractors that require you to sign over your insurance proceeds or that guarantee to cover your deductible through inflated estimates. These practices are illegal in many states and can result in poor workmanship or legal complications.

Successfully navigating a roof insurance claim after Texas severe storms requires preparation, documentation, and working with experienced professionals. By understanding your policy, documenting damage thoroughly, and choosing qualified contractors, you can ensure your roof replacement project protects your home and maximizes your insurance benefits for years to come.

Texas Panhandle Climate Challenges and Material Specifications

The Texas Panhandle's extreme climate demands roofing materials engineered to withstand intense temperature fluctuations, frequent hail events, and sustained high winds. During insurance evaluations, adjusters specifically look for materials rated to handle the region's severe conditions. Impact-resistant shingles with Class 4 UL 2218 ratings are increasingly recommended for Amarillo homes, as they demonstrate superior performance against the golf ball-sized hail common to our area. These materials often qualify homeowners for insurance premium discounts of 10-35%, making them financially advantageous even before storm damage occurs.

When documenting storm damage for your insurance claim, understanding wind load requirements becomes crucial. The International Building Code requires residential roofing systems in our region to withstand wind speeds of at least 90 mph, with many areas requiring 110 mph ratings due to historical weather patterns. However, the National Severe Storms Laboratory data shows that the Texas Panhandle experiences straight-line winds exceeding 100 mph multiple times per year, often causing uplift damage that may not be immediately visible from ground level.

Professional Documentation and Safety Compliance

Insurance companies increasingly require professional roof inspections that comply with OSHA safety standards for fall protection when assessing storm damage claims. DIY roof inspections not only pose significant safety risks but may also invalidate your claim if injuries occur during the documentation process. Professional roofing contractors use proper safety equipment and follow established protocols that protect both the inspector and the integrity of your insurance claim.

The Insurance Institute for Business & Home Safety research demonstrates that homes built to FORTIFIED standards experience 95% less damage during severe weather events compared to standard construction. When filing your insurance claim, highlighting any existing fortified construction features or proposing upgrades to fortified specifications can significantly improve your settlement outcome and reduce future premium costs.

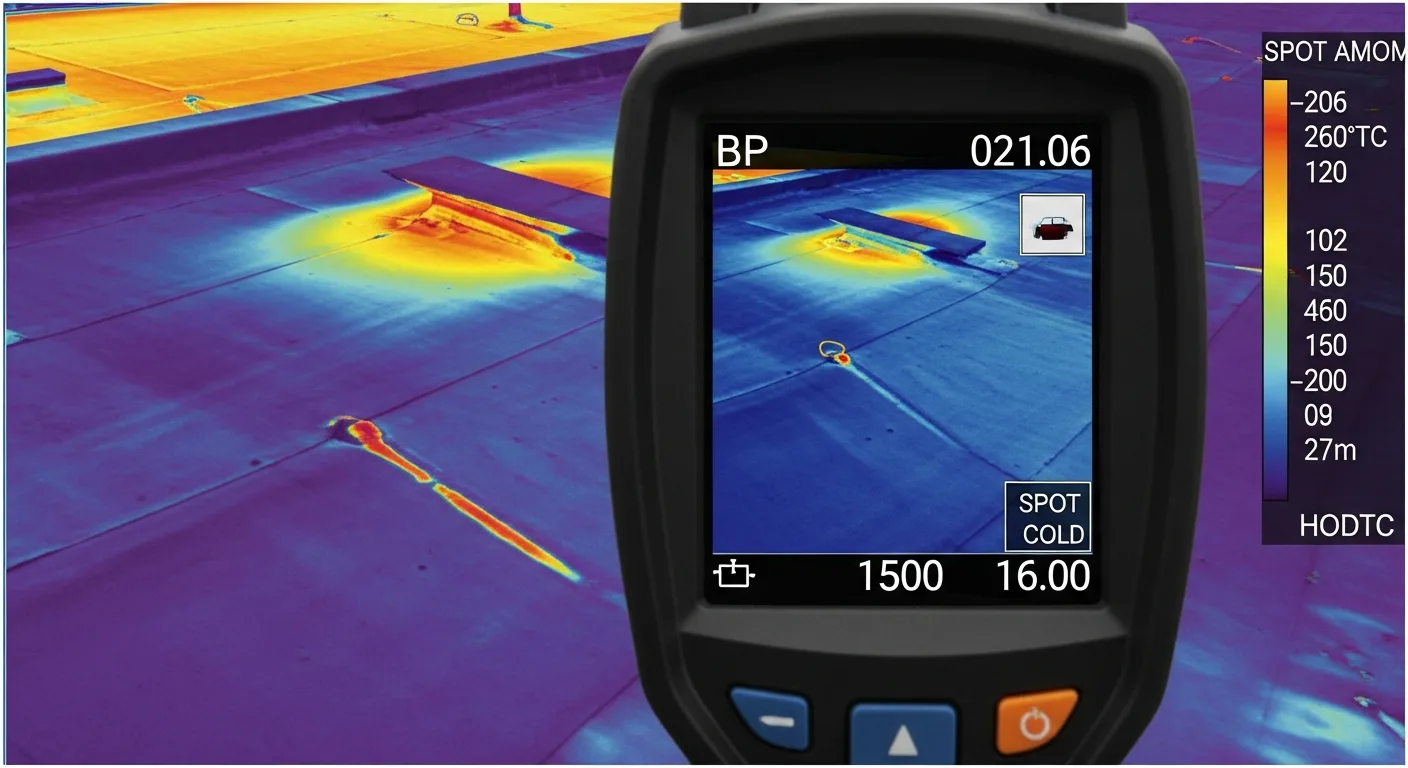

For commercial properties or extensive residential damage, insurance adjusters often require detailed thermal imaging to identify compromised insulation and moisture infiltration that isn't visible during standard inspections. These advanced diagnostic techniques help ensure that all storm-related damage is properly documented and included in your settlement, preventing costly callbacks and additional claims down the road.