Texas Panhandle homeowners face a harsh reality: severe weather strikes with devastating frequency, leaving behind roof damage that can cost thousands to repair. The difference between an approved insurance claim and an out-of-pocket expense often comes down to understanding what constitutes eligible damage and acting swiftly. With IBHS research showing that wind speeds in the Texas Panhandle regularly exceed 70 mph during storms, waiting to assess damage can result in moisture intrusion, compromised building envelope integrity, and claim denials due to progressive deterioration.

When Roof Damage Requires Professional Insurance Assessment

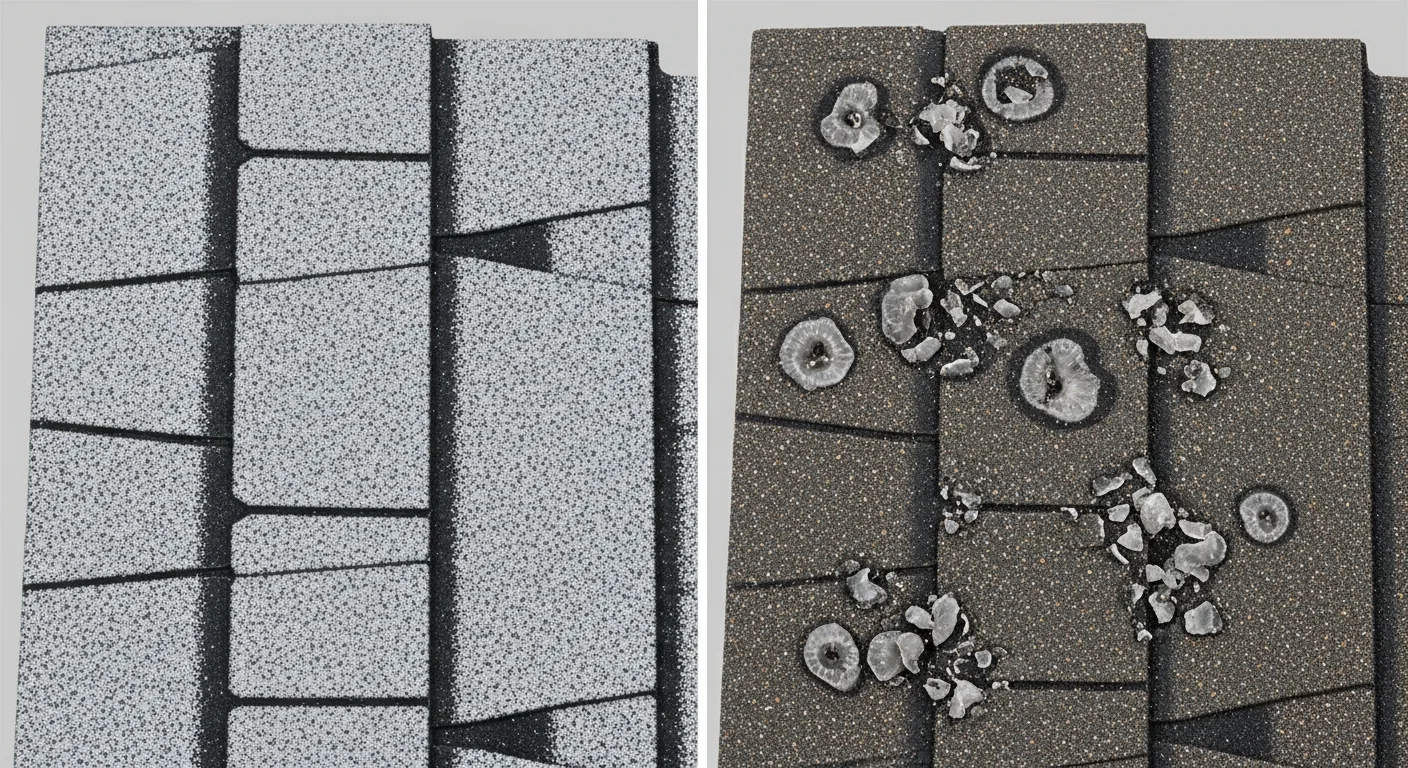

Insurance companies operate on strict definitions of covered perils, making professional assessment critical for Texas Panhandle property owners. Hail damage represents the most common eligible claim in our region, with impacts creating bruising on asphalt shingles, cracking ceramic tiles, and denting metal roofing systems. Wind damage becomes eligible when sustained winds or gusts exceed your policy's threshold, typically causing shingle blow-offs, membrane seam separation, or complete roof system failure.

Storm-related damage must show clear evidence of sudden and accidental occurrence. Gradual deterioration, maintenance issues, or pre-existing conditions don't qualify for coverage. Professional contractors can distinguish between eligible storm damage and normal wear, documenting impact marks, measuring hail spatter patterns, and identifying wind uplift characteristics that insurance adjusters recognize as legitimate claims.

The Texas Department of Insurance requires specific documentation standards for weather-related claims. Thermal imaging can reveal hidden moisture intrusion from compromised membrane seams, while drone inspections capture comprehensive damage patterns across your entire roof system. This professional documentation proves essential when insurance companies question claim validity or attempt to minimize settlement amounts.

Key Decision Factors for Insurance Claims Success

Several critical factors determine whether your roof damage qualifies for insurance coverage and the scope of approved repairs or replacement. Policy language varies significantly between carriers, with some covering full replacement when damage exceeds specific thresholds while others limit coverage to actual repair costs. Understanding your coverage limits, deductibles, and replacement cost provisions directly impacts your out-of-pocket expenses.

Timing becomes absolutely crucial in the Texas Panhandle climate. Insurance policies typically require prompt notification of damage, often within 30-60 days of discovery. More importantly, allowing damaged roofing materials to deteriorate through additional weather exposure can void coverage for subsequent damage. High winds and extreme temperature swings characteristic of our region accelerate deterioration once the building envelope is compromised.

The age and condition of your existing roof system influences coverage eligibility. Newer roofing materials with documented maintenance records receive more favorable consideration than older systems showing signs of normal wear. However, even well-maintained older roofs can qualify for full replacement when storm damage is extensive enough to compromise structural integrity or water-tightness.

Professional contractors familiar with insurance requirements can perform lifecycle cost analysis to demonstrate when replacement offers better long-term value than extensive repairs. This analysis becomes particularly compelling when factoring in energy efficiency improvements through higher R-value insulation and enhanced thermal reflectivity of modern roofing systems.

Material and System Considerations for Insurance Claims

Insurance companies evaluate damage based on the specific roofing materials and installation methods involved. Impact-resistant shingles with Class 4 ratings may qualify for premium discounts but also demonstrate higher durability standards when damage occurs. Energy Star certified products often receive favorable consideration for replacement claims due to their documented performance standards and lifecycle value.

Metal roofing systems present unique considerations for insurance assessments. While highly durable against wind uplift, hail impacts can create cosmetic damage that affects both thermal reflectivity and long-term performance. Insurance adjusters require specific expertise to evaluate whether denting compromises the metal's protective coatings or structural integrity.

Commercial roofing systems involve more complex eligibility criteria due to their membrane-based construction and specialized drainage requirements. EPDM, TPO, and modified bitumen systems each respond differently to storm damage, requiring contractors certified in specific manufacturer warranties to properly assess and document insurance-eligible conditions.

Code compliance issues frequently arise during insurance claims, particularly when existing roofing systems don't meet current standards. Many policies include ordinance or law coverage that pays for upgrades required by local building codes, but these provisions must be specifically activated and documented during the claims process.

What to Expect During the Insurance Claims Process

The insurance claims process for roof damage follows a structured timeline that property owners must navigate carefully to maximize their settlement. Initial reporting triggers a claims adjuster assignment, typically within 5-10 business days for weather-related damage in Texas. However, major storm events can extend this timeline significantly, making early documentation critical.

Professional documentation should begin immediately after discovering damage, before the insurance adjuster arrives. Comprehensive photo documentation, moisture mapping, and detailed damage assessments provide leverage during negotiations. Experienced contractors understand which damage indicators insurance companies prioritize and can present evidence in formats adjusters readily accept.

The adjuster's inspection focuses on determining coverage eligibility and estimating repair costs. Property owners have the right to have their contractor present during this inspection, ensuring all damage receives proper consideration. Adjusters may miss interior damage, secondary weather infiltration, or code compliance requirements that affect the final settlement amount.

Disputed claims require additional documentation and may involve independent adjusters or umpire processes. Contractors experienced in insurance work can provide detailed repair estimates, manufacturer specifications, and installation documentation that supports your position during disputes. Our experience with Texas Panhandle insurance companies helps navigate these challenges efficiently.

Claim settlements typically cover materials, labor, and permits at current market rates. However, homeowners should verify that settlements account for local labor premiums, disposal costs, and temporary protection measures required during construction. Experienced roofing contractors can review settlement documents to ensure adequate coverage before work begins.

Why Choosing the Right Contractor Matters for Insurance Success

Selecting a contractor with proven insurance experience directly impacts your claim's success and final settlement amount. Insurance companies work more readily with established contractors who understand documentation requirements, provide detailed estimates, and complete work according to manufacturer specifications. Contractors lacking this experience may inadvertently compromise your claim through inadequate documentation or substandard repairs.

Manufacturer certifications and industry credentials demonstrate contractor expertise that insurance companies recognize and trust. GAF Master Elite contractors, CertainTeed SELECT ShingleMaster companies, and NRCA members receive favorable consideration because their training ensures proper installation techniques and warranty compliance. These credentials often influence both claim approval and settlement amounts.

Local contractors familiar with Texas Panhandle weather patterns and regional insurance practices provide significant advantages during the claims process. We understand which damage indicators local adjusters prioritize, how regional weather affects different roofing materials, and which documentation formats expedite claim processing. This regional expertise translates directly into faster approvals and more comprehensive settlements.

Choosing contractors who guarantee their work and maintain proper licensing and insurance protects property owners throughout the claims and repair process. Uninsured or inadequately licensed contractors can void insurance coverage, while contractors without established warranty programs leave property owners vulnerable to future problems. See our service area pages for availability to verify our coverage and credentials in your location.

Professional contractors also provide ongoing support during warranty periods and future insurance interactions. Documented maintenance records, warranty compliance, and professional installation photographs become valuable assets for future claims or property transfers. This long-term relationship approach ensures your roofing investment remains protected and insurance-eligible for years to come.

Don't let insurance companies minimize your legitimate roof damage claim. Contact CRS Roofing & Construction today for professional damage assessment and insurance claim support. Our certified team understands exactly what documentation insurance companies require and will work directly with your adjuster to ensure you receive the full settlement you deserve. Call now to schedule your comprehensive roof inspection and take the first step toward restoring your property's protection and value. Every day you wait allows additional damage to occur and potentially compromises your coverage eligibility.

The Texas Panhandle's extreme climate conditions require roofing systems that meet specific performance standards for insurance eligibility. According to National Severe Storms Laboratory research, our region experiences some of the most severe hail events in the United States, with stones reaching softball size and impact velocities exceeding 100 mph. For this reason, impact-resistant shingles meeting ASTM D3161 Class F wind resistance standards and UL 2218 Class 4 impact ratings are increasingly required by insurers offering premium discounts.

When documenting wind damage for insurance claims, professional assessors look for specific failure modes that indicate sudden storm events rather than gradual deterioration. GAF's Timberline HD shingles, commonly installed in our region, show characteristic patterns when damaged by qualifying wind events: mat splitting along the nail line, granule loss in concentrated areas, and lifting that creates moisture entry points. These patterns help distinguish between storm damage and normal weathering, which is crucial for claim approval.

Temperature extremes in the Texas Panhandle create additional challenges for roof system integrity and insurance assessments. Summer temperatures regularly exceed 100°F, causing thermal expansion and contraction that can compromise fastener integrity and membrane seam performance. NRCA guidelines specify that roof inspections should account for thermal movement, particularly in metal roofing systems where expansion joints may fail during extreme weather events. Insurance adjusters trained in Texas climate conditions understand these failure modes and can properly attribute damage to covered storm events versus normal thermal cycling.

For commercial properties, single-ply membrane systems face unique challenges in our climate that affect insurance eligibility determinations. TPO and EPDM membranes must demonstrate compliance with FM Global wind uplift standards, particularly FM 1-90 requirements for high-velocity hurricane zones. When storm damage occurs to properly installed systems meeting these standards, insurance coverage typically applies. However, systems installed below code requirements or with inadequate fastening patterns may face coverage denials, making professional documentation of installation standards critical for successful claims.