Dealing with roof damage from severe weather in the Texas Panhandle can be overwhelming, especially when navigating insurance claims. High winds, hail, and extreme temperature fluctuations are common in our region, often resulting in significant roofing damage that requires professional attention. Understanding how to work with your insurance company to secure a fair payout is crucial for protecting your home and financial investment.

Understanding Your Insurance Policy Coverage

Before filing a claim, it's essential to thoroughly understand your homeowner's insurance policy. Most standard policies cover sudden and accidental damage from weather events like hail, wind, and storms. However, coverage can vary significantly between insurers and policies. Review your policy documents carefully, paying attention to your deductible, coverage limits, and any exclusions that might apply to roof damage.

The Insurance Institute for Business & Home Safety (IBHS) emphasizes that homeowners should be familiar with their policy terms before disaster strikes. Many policies include specific provisions for roof damage, including whether they cover replacement cost or actual cash value. Replacement cost coverage typically provides better protection, as it pays for repairs or replacement at current market prices without depreciation.

Key Policy Elements to Review

Your policy's dwelling coverage should be sufficient to replace your roof entirely if necessary. In the Panhandle, where severe weather is frequent, ensure your coverage limits account for potential increases in material and labor costs. Additionally, check if your policy includes coverage for additional living expenses if roof damage makes your home temporarily uninhabitable.

Some policies may have specific wind or hail deductibles that differ from your standard deductible. These can be percentage-based rather than fixed amounts, potentially resulting in higher out-of-pocket costs for weather-related claims.

Documenting Roof Damage Properly

Proper documentation is the foundation of a successful insurance claim. After ensuring your safety, begin documenting damage as soon as possible after a storm. Take comprehensive photographs and videos of all visible damage, both close-up and wide-angle shots. Include images of the roof from multiple angles, damaged gutters, siding, and any interior damage caused by leaks.

Professional roof inspections are invaluable for identifying damage that may not be visible from the ground. At CRS Roofing & Construction, our experienced team can provide detailed documentation that insurance companies require for processing claims. We understand what adjusters look for and can help ensure nothing is overlooked during the assessment process.

Creating a Damage Inventory

Maintain detailed records of all damage, including dates, weather conditions, and specific areas affected. Keep receipts for any temporary repairs or emergency services needed to prevent further damage. Document any personal property damaged due to roof leaks, as this may be covered under your policy's contents coverage.

The Federal Emergency Management Agency (FEMA) recommends creating a comprehensive inventory that includes serial numbers, purchase dates, and estimated values for damaged items. This documentation will be crucial when working with your insurance adjuster.

Working Effectively with Insurance Adjusters

When your insurance company assigns an adjuster to your claim, preparation is key to ensuring a fair evaluation. Be present during the adjuster's inspection and provide all documentation you've gathered. Ask questions about their assessment process and request explanations for any damage they don't include in their report.

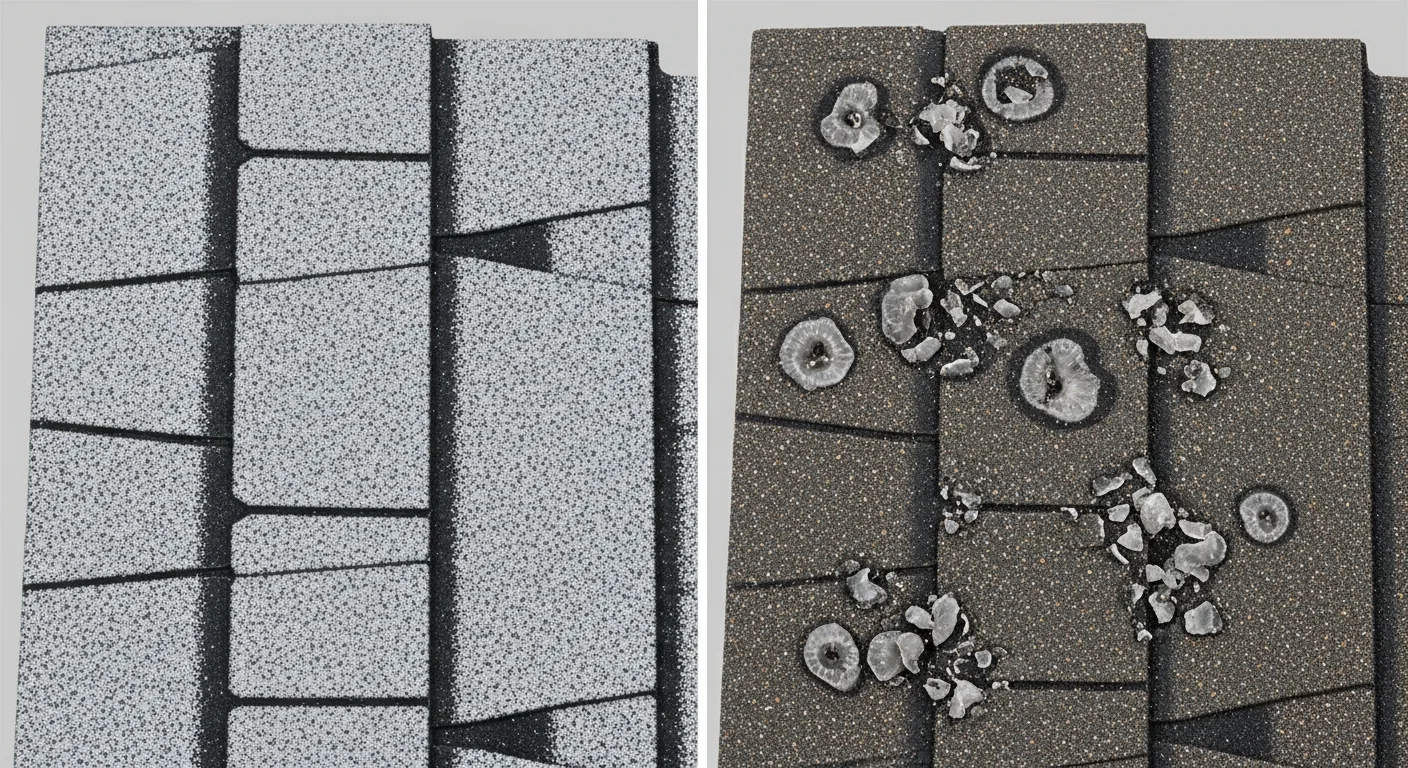

Insurance adjusters may not always catch every type of damage, particularly subtle issues like granule loss on shingles or minor membrane damage on flat roofs. Having a professional roofing contractor present during the inspection can help identify damage that might otherwise be overlooked. Our team at CRS Roofing & Construction regularly assists homeowners during adjuster visits, providing expert insights that often result in more comprehensive claim approvals.

Common Adjuster Oversights

Adjusters may miss damage to roof accessories like vents, flashing, and gutters, or they might not fully assess the impact of granule loss on shingle longevity. They may also underestimate the extent of damage to roofing systems that aren't immediately visible, such as decking damage or compromised underlayment.

The National Roofing Contractors Association (NRCA) provides guidelines for proper roof inspections that can help you understand what should be included in a thorough damage assessment. Use these resources to ensure your adjuster's evaluation is complete.

Negotiating Your Insurance Settlement

If you believe your insurance company's initial settlement offer is insufficient, you have the right to negotiate. Gather additional evidence, including contractor estimates, manufacturer specifications, and expert opinions to support your position. Multiple estimates from reputable contractors can demonstrate that your claim amount is reasonable and necessary for proper repairs.

When negotiating, focus on specific items that were undervalued or omitted from the original assessment. Present clear evidence for each disputed item, including photographs, expert opinions, and industry standards. Be persistent but professional in your communications with the insurance company.

When to Consider Professional Help

Complex claims or significant disputes may require professional assistance. Public adjusters can represent your interests in negotiations with the insurance company, though they typically charge a percentage of your settlement. Alternatively, working with an experienced roofing contractor who understands insurance processes can provide valuable guidance without additional fees.

If you're struggling with your insurance claim process, don't hesitate to seek professional help from our experienced team. We've successfully assisted hundreds of Panhandle homeowners in securing fair insurance settlements for their roof damage claims.

Understanding Storm Damage Types in the Panhandle

The Texas Panhandle experiences unique weather patterns that create specific types of roof damage. Hail damage is particularly common, ranging from subtle granule loss to significant impact damage that requires immediate attention. Wind damage often manifests as lifted or missing shingles, damaged flashing, or structural issues that compromise your roof's integrity.

Understanding these damage types helps you communicate effectively with adjusters and ensures proper assessment. Storm damage can be cumulative, meaning multiple weather events may contribute to your roof's deterioration over time. Insurance companies should consider this cumulative effect when evaluating claims.

Seasonal Considerations

Spring and early summer bring the most severe weather to our region, making this the prime time for roof damage. However, winter freeze-thaw cycles and extreme temperature fluctuations can also cause significant damage, particularly to older roofing systems. The Department of Energy (DOE) notes that temperature extremes can cause roofing materials to expand and contract, leading to cracking, splitting, and seal failures.

Preventing Claim Delays and Denials

Timely filing is crucial for insurance claims success. Most policies require notification within a specific timeframe after damage occurs. File your claim promptly, even if you haven't completed a full damage assessment. You can always supplement your claim with additional information as it becomes available.

Maintain detailed records of all communications with your insurance company, including claim numbers, adjuster contact information, and summaries of phone conversations. Follow up regularly on claim progress and request updates in writing when possible.

Avoid making permanent repairs until your insurance company has approved your claim, unless the repairs are necessary to prevent further damage. Keep receipts for any emergency repairs and document the necessity for immediate action to protect your home.

Working with experienced professionals throughout the insurance claim process significantly increases your chances of receiving a fair settlement. Our team at CRS Roofing & Construction has extensive experience helping Panhandle homeowners navigate insurance claims, from initial damage assessment through final settlement. We understand the unique challenges our region faces and work diligently to ensure our customers receive the coverage they deserve for quality roof repairs and replacements.

The Texas Panhandle's unique climate presents specific challenges that insurance adjusters must understand when evaluating roof damage. NOAA weather data shows our region experiences some of the most severe hailstorms in the nation, with hailstones often exceeding 2 inches in diameter and wind speeds regularly reaching 70+ mph during severe weather events. These conditions can cause significant damage even to impact-resistant roofing materials, making proper documentation crucial for insurance claims.

When documenting roof damage for your insurance claim, it's important to understand the industry standards that adjusters use to evaluate damage severity. The Insurance Institute for Business & Home Safety (IBHS) has established specific criteria for assessing hail damage, including the number of hits per square, bruising patterns on shingles, and damage to gutters and flashing. For wind damage, adjusters look for loose or missing shingles, exposed nail heads, and damage to roof edges where uplift forces are strongest.

The extreme temperature fluctuations common in the Panhandle—often ranging from below freezing to over 100°F within the same season—can accelerate roofing material deterioration and compound storm damage. These thermal cycles cause expansion and contraction that can loosen fasteners and create vulnerabilities that may not be immediately visible. When filing your claim, ensure your contractor documents all forms of damage, including thermal-related deterioration that may have been exacerbated by recent storms.

Modern impact-resistant shingles, such as those meeting UL 2218 Class 4 impact standards, are increasingly important for Texas Panhandle homes. Many insurance companies now offer discounts for Class 4 rated materials from manufacturers like GAF's Timberline HD series, which are designed to withstand 2-inch hailstone impacts. When working with your adjuster, having documentation of your roof's impact resistance rating can significantly support your claim and potentially reduce future premiums.

For commercial properties, understanding the wind uplift ratings required by local building codes is essential. The National Roofing Contractors Association (NRCA) provides guidelines that many adjusters reference when evaluating whether repairs meet current code requirements. In the Texas Panhandle, wind uplift requirements are particularly stringent due to our exposure to severe weather, and insurance settlements should account for bringing older roofs up to current standards when replacement is necessary.