For commercial property owners, a new roof represents one of the largest capital investments you'll make, often ranging from $50,000 to $500,000 or more depending on building size and materials. Understanding how to calculate the return on investment (ROI) helps justify this expense and demonstrates the long-term financial benefits beyond simply keeping water out of your building.

What Commercial Roof ROI Means and Why It Matters

Commercial roof ROI encompasses multiple financial benefits that extend far beyond the initial installation cost. Unlike residential properties where curb appeal drives much of the value, commercial roofing ROI focuses on measurable operational savings, property value enhancement, and risk mitigation that directly impacts your bottom line.

The building envelope performance of modern roof systems creates quantifiable savings through reduced energy consumption, lower maintenance requirements, and improved tenant satisfaction. Property owners who understand these metrics can make informed decisions about roof system upgrades and present compelling cases to stakeholders, lenders, or investment partners.

A properly calculated ROI analysis also helps determine optimal timing for roof replacement. Waiting too long can result in emergency repairs, business interruption, and interior damage that dramatically increases total costs while reducing the financial benefits of a planned replacement.

Key Financial Factors in Commercial Roof ROI

Energy Efficiency Savings

Modern commercial membrane systems like TPO, EPDM, and PVC offer superior thermal reflectivity compared to older built-up roofing. Cool roof technologies can reduce cooling costs by 15-25% in Texas Panhandle climates where extreme summer temperatures drive high energy consumption. For a 50,000 square foot building spending $30,000 annually on cooling, this translates to $4,500-$7,500 in yearly savings.

The Department of Energy's cool roof standards provide benchmarks for thermal performance that help quantify these savings. Higher R-value insulation systems installed during roof replacement can further enhance energy efficiency, creating compound savings over the roof system lifespan.

Maintenance and Repair Cost Reduction

Aging roof systems typically require increasing maintenance investments as they approach end-of-life. Emergency repairs, temporary fixes, and frequent inspections can cost $2-5 per square foot annually for deteriorating systems. New commercial roofing eliminates these expenses for the first 10-15 years while providing predictable warranty coverage.

Modern membrane systems also resist ponding water issues that plague older roofs, reducing drainage maintenance and preventing moisture intrusion that leads to costly interior repairs. The improved drainage dynamics of properly designed new roofs eliminate recurring leak repairs that can cost thousands of dollars per incident.

Property Value Enhancement

Commercial appraisers recognize roof condition as a significant factor in property valuation. A new roof system typically adds 60-80% of its cost to property value, with higher percentages for buildings where the old roof was severely compromised. For investment properties, this value increase improves equity positions and refinancing opportunities.

Tenant attraction and retention also improve with new roofing. Modern roof systems prevent leaks that can damage tenant equipment, interrupt business operations, and create liability issues. This reliability often justifies higher rental rates and reduces vacancy periods.

ROI Calculation Methods and Formulas

Simple Payback Period

The most straightforward calculation divides total roof replacement cost by annual savings to determine payback years. For example, a $200,000 roof replacement generating $15,000 annually in energy savings plus $8,000 in maintenance cost avoidance provides a payback period of 8.7 years ($200,000 ÷ $23,000 = 8.7 years).

Net Present Value (NPV)

NPV calculations account for the time value of money and provide more accurate long-term ROI analysis. This method discounts future savings to present value using your cost of capital, typically 6-10% for commercial properties. Professional financial analysis software or consultation with your accountant ensures accurate NPV calculations for major roofing investments.

Total Cost of Ownership

This comprehensive approach compares the total 20-30 year costs of roof replacement versus continued maintenance of existing systems. Include energy costs, maintenance expenses, emergency repairs, business interruption costs, and end-of-life replacement in both scenarios to identify the true financial impact.

Special Considerations for Storm-Prone Areas

Texas Panhandle commercial properties face unique ROI factors due to severe weather patterns including high winds, hailstorms, and extreme temperature fluctuations. Impact-resistant commercial roofing systems may qualify for insurance premium reductions of 10-25%, creating additional annual savings that improve ROI calculations.

Wind uplift resistance ratings become critical financial considerations in high-wind areas. Roof systems meeting NRCA wind resistance standards reduce the risk of catastrophic damage that can cost hundreds of thousands in repairs plus business interruption losses.

Hail-resistant membranes and improved drainage systems prevent recurring storm damage that requires frequent insurance claims and potential policy cancellations. These protective features create measurable risk reduction that contributes to long-term ROI through avoided losses rather than direct savings.

Emergency roof repairs during severe weather often cost 2-3 times normal rates due to material shortages and contractor availability. Proactive roof replacement eliminates these premium emergency costs while ensuring business continuity during severe weather events common in the Texas Panhandle.

Tax Benefits and Financing Considerations

Commercial roof replacement often qualifies for accelerated depreciation under Section 179 or bonus depreciation rules, allowing immediate tax deductions that improve cash flow and effective ROI. Energy-efficient roof systems may qualify for additional tax credits or utility rebates that reduce net investment costs.

Financing options including equipment financing, SBA loans, or PACE programs can spread costs over 10-20 years while preserving capital for other investments. When financing costs are lower than generated savings, positive cash flow begins immediately, creating attractive ROI scenarios for property owners.

When to Call a Professional Commercial Roofer

Accurate ROI calculations require detailed assessment of your existing roof condition, building energy performance, and local climate factors. Professional commercial roofers provide comprehensive evaluations that identify specific savings opportunities and quantify potential benefits based on your building's unique characteristics.

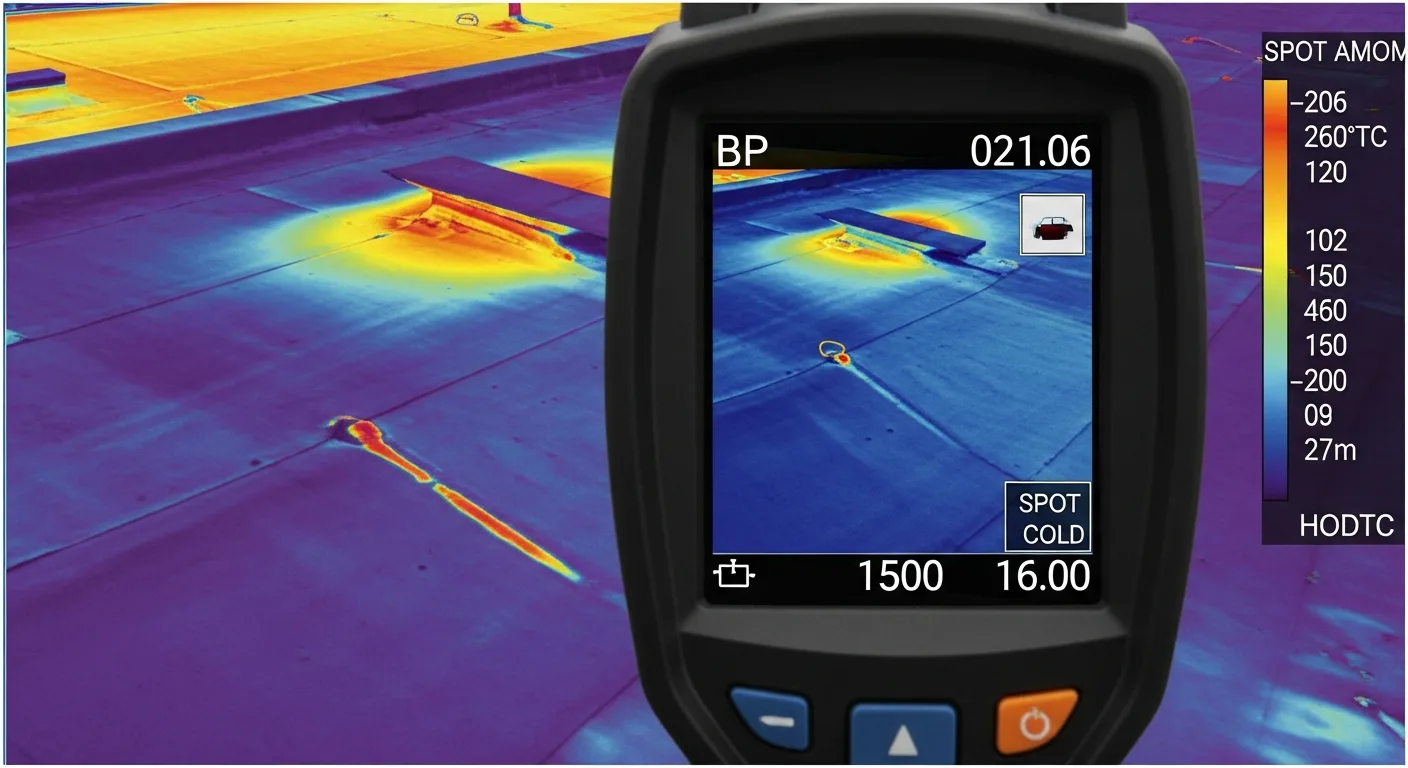

Our team conducts thorough roof system analysis including thermal imaging, core sampling, and energy efficiency assessments to develop accurate ROI projections for your property. We'll help you understand how modern commercial membrane systems can improve your building's performance while providing detailed cost-benefit analysis to support your investment decision.

Don't let an aging roof system drain your profits through increasing maintenance costs and energy inefficiency. Contact us today to explore our commercial roofing services and discover how a new roof investment can enhance your property's financial performance for decades to come.

In the Texas Panhandle's extreme climate conditions, commercial roof ROI calculations must account for specific environmental factors that significantly impact long-term performance. The region's intense UV exposure, frequent hailstorms, and high winds exceeding 70 mph during severe weather events create unique demands on roofing systems. Energy efficiency considerations become particularly critical, as cooling costs can represent 40-60% of a commercial building's total energy consumption during Amarillo's scorching summers.

When evaluating commercial roofing materials for ROI analysis, single-ply membrane systems like TPO and EPDM offer measurable benefits in the Panhandle climate. TPO membrane systems with high solar reflectance values can reduce roof surface temperatures by 50-80°F compared to traditional built-up roofing, translating to immediate energy savings. For buildings requiring enhanced durability against hail damage, FORTIFIED Commercial standards provide quantifiable risk reduction metrics that insurance providers increasingly recognize with premium discounts of 10-25%.

Metal roofing systems present compelling ROI opportunities for commercial properties, particularly when factoring in the Texas Panhandle's severe weather patterns. Standing seam metal roofing systems engineered for high wind uplift resistance can withstand wind speeds up to 120 mph when properly installed, significantly reducing storm damage claims and emergency repair costs. The reflective properties of modern metal systems, combined with proper insulation to meet Texas energy code requirements, can reduce cooling loads by 20-30% compared to conventional roofing.

Code compliance and safety considerations directly impact ROI calculations through risk mitigation and operational continuity. NRCA best practices emphasize that properly installed commercial roofing systems meeting current wind uplift standards can prevent catastrophic failures that result in business interruption costs often exceeding the roof replacement investment. Cool roof technology ratings help property owners quantify energy performance benefits, with certified cool roof systems eligible for utility rebates and tax incentives that improve overall ROI by 15-20% in many Texas markets.