Insurance underpayment on roofing claims has become increasingly common, with many property owners receiving settlements that fall significantly short of actual repair costs. Understanding how to properly document damage, navigate the claims process, and advocate for fair compensation can mean the difference between a successful roof replacement and costly out-of-pocket expenses.

Why Insurance Underpayment Occurs and What It Costs You

Insurance companies operate as businesses focused on minimizing claim payouts while maintaining profitability. This fundamental reality creates inherent tension between policyholder needs and insurer objectives. Roofing claims represent some of the largest residential insurance payouts, making them prime targets for cost-cutting measures.

Common underpayment scenarios include inadequate replacement cost valuations, failure to account for code upgrade requirements, incomplete damage assessments, and disputes over the extent of storm damage. When your roof system requires comprehensive repair or replacement, even a 20-30% underpayment can leave you facing thousands in unexpected costs.

The building envelope depends on proper roofing system integration, and partial repairs often fail to address underlying moisture intrusion risks or wind uplift resistance requirements. This creates long-term liability that extends well beyond the initial claim settlement.

Essential Documentation Strategies

Successful claim outcomes begin with thorough documentation before, during, and after storm events. Pre-storm roof condition documentation provides crucial baseline evidence that helps distinguish new damage from pre-existing conditions.

Pre-Storm Documentation

Maintain current photographs of your roof system from multiple angles, including close-ups of shingles, flashing, gutters, and penetrations. Document your roof's age, material specifications, and any previous repairs or maintenance. Keep detailed records of professional inspections and warranty information.

Post-Storm Evidence Collection

After severe weather events, document all visible damage immediately while maintaining safety protocols. Photograph hail impact marks, missing or damaged shingles, compromised flashing, and any signs of moisture intrusion. Include reference objects in photos to demonstrate scale and severity.

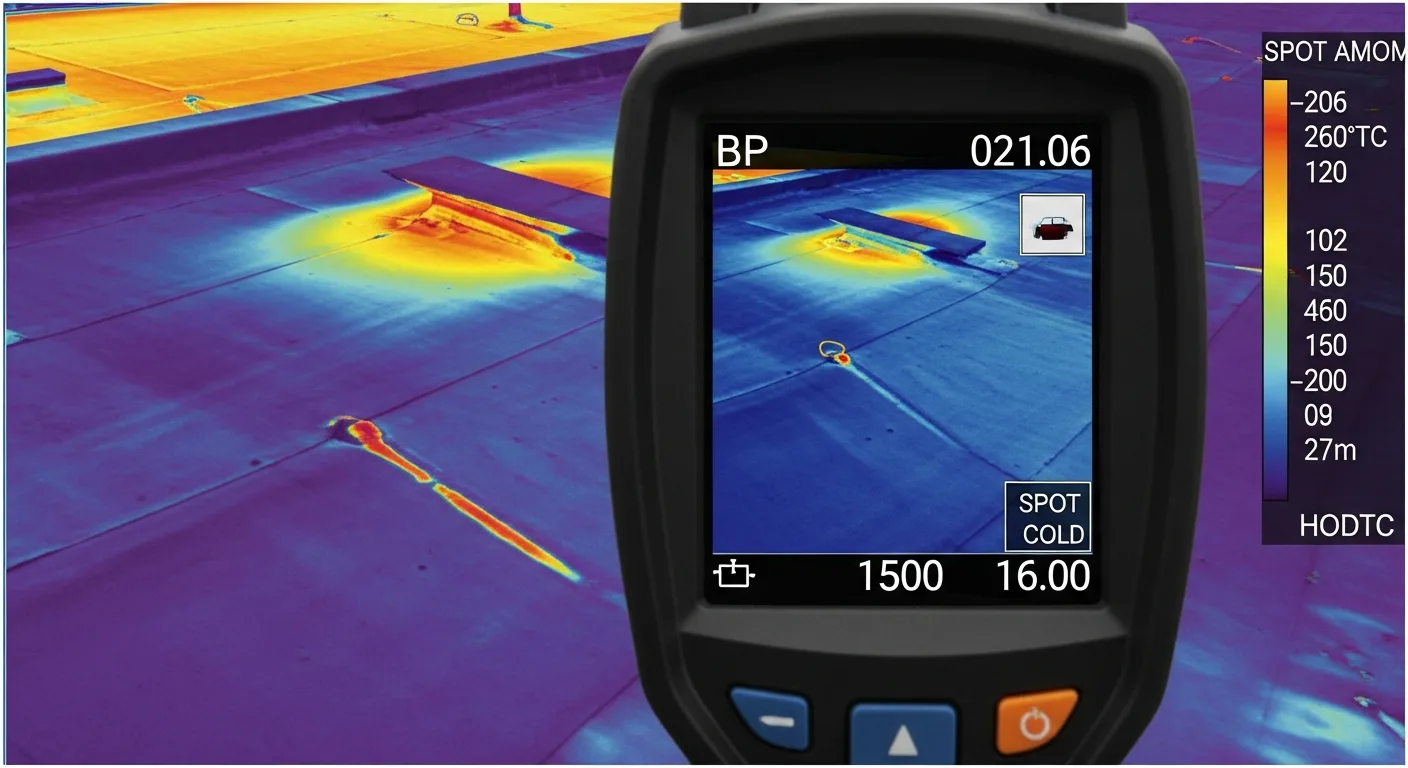

Interior documentation proves equally important. Water stains, damaged insulation, and compromised structural elements provide evidence of roof system failure that may not be visible from exterior inspections alone.

Understanding Adjuster Tactics and Industry Practices

Insurance adjusters employ various strategies to minimize claim values, often taking advantage of policyholder unfamiliarity with roofing terminology and industry standards. Recognizing these tactics empowers you to respond effectively and protect your interests.

Common Underpayment Methods

Adjusters may dispute the extent of damage, arguing that visible impact marks don't constitute functional impairment. They might classify storm damage as "cosmetic only" or attribute damage to normal wear rather than covered perils. Some adjusters underestimate square footage calculations or use outdated material cost databases.

Depreciation schedules often become contentious, particularly regarding recoverable depreciation timelines and requirements. Understanding your policy's actual cash value versus replacement cost provisions prevents surprises during the settlement process.

Professional Assessment Benefits

Independent roofing contractors bring specialized expertise that insurance adjusters may lack. Professional roofers understand roof system lifespan expectations, can identify subtle damage indicators, and recognize code compliance requirements that impact replacement costs.

When you explore our roof inspection services, experienced professionals document damage using industry-standard terminology and provide detailed estimates based on current material and labor costs. This professional documentation strengthens your negotiating position significantly.

Maximizing Your Settlement Through Strategic Preparation

Successful claim outcomes require proactive preparation and strategic communication with insurance representatives. Understanding policy language, coverage limits, and claim procedures prevents common pitfalls that lead to underpayment.

Policy Review and Understanding

Review your insurance policy thoroughly before filing claims. Understanding coverage limitations, deductible structures, and exclusions prevents unrealistic expectations and helps identify potential disputes before they arise.

Pay particular attention to actual cash value versus replacement cost coverage, code upgrade provisions, and any special endorsements that might affect roofing claims. The Federal Emergency Management Agency provides guidance on building code requirements that often impact insurance settlements.

Professional Estimates and Specifications

Obtain multiple estimates from licensed roofing contractors who understand local building codes and climate-specific requirements. Detailed estimates should include material specifications, labor costs, and any necessary upgrades to meet current code requirements.

In the Texas Panhandle, impact-resistant shingles and enhanced wind uplift resistance often represent mandatory upgrades that insurers must cover. Professional contractors familiar with regional requirements ensure these costs are properly documented and claimed.

Navigating High-Wind and Hail-Prone Regional Challenges

Texas Panhandle weather patterns create unique challenges for roofing systems and insurance claims. High winds, severe hailstorms, and extreme temperature fluctuations demand specialized roofing solutions that standard adjusting practices may not fully recognize.

Wind uplift resistance requirements in high-wind zones often exceed basic roofing system specifications. When storm damage occurs, replacement systems must meet current wind load requirements, which may significantly exceed original installation standards.

Hail damage assessment requires understanding impact-resistant material benefits and recognizing that granule loss, exposed mat, and fractured shingles compromise long-term roof system performance. The Insurance Institute for Business & Home Safety provides research supporting the importance of comprehensive hail damage evaluation.

Climate-Specific Documentation

Regional weather data strengthens damage claims by establishing storm severity and duration. National Weather Service records, local storm reports, and neighboring property damage provide contextual evidence supporting your claim's legitimacy.

Thermal reflectivity requirements and energy efficiency standards in hot climates may necessitate specific material selections that affect replacement costs. Cool roof technology and enhanced insulation requirements represent legitimate claim expenses that adjusters may initially overlook.

When to Call a Professional Roofer

Professional roofing expertise becomes essential when insurance adjusters dispute damage extent, question repair necessity, or propose settlements below reasonable replacement costs. Experienced contractors understand industry standards, material specifications, and installation requirements that ensure proper roof system performance.

If your initial claim settlement seems inadequate, professional assessment helps identify overlooked damage, code compliance requirements, and material cost discrepancies. Contractors familiar with insurance claim procedures can provide expert testimony and detailed documentation supporting claim appeals.

Consider professional assistance when adjusters propose repair methods that compromise roof system integrity, suggest substandard materials, or dispute obvious storm damage. Early professional involvement often prevents lengthy disputes and ensures fair settlement outcomes.

For comprehensive storm damage assessment and insurance claim support, visit our hail and wind damage repair page to learn how professional documentation and advocacy can protect your property investment and ensure fair insurance settlements.

The Texas Panhandle's extreme climate conditions create unique challenges for insurance claim evaluations. With summer temperatures regularly exceeding 100°F and sudden temperature swings of 40-50 degrees, roofing materials face thermal cycling stress that accelerates deterioration. National Weather Service data shows the Amarillo region experiences some of the nation's most severe hail activity, with storms producing softball-sized hail that can compromise even impact-resistant shingles rated for Class 4 impact resistance.

When documenting storm damage, ensure your contractor understands ASTM testing standards for impact resistance and wind uplift ratings. Standard three-tab shingles typically carry wind ratings of 60-70 mph, while architectural shingles like GAF's Timberline series offer enhanced wind resistance up to 130 mph when properly installed. Insurance adjusters often undervalue the importance of proper installation techniques, including adequate nail placement and starter strip applications that directly affect wind uplift performance.

Code compliance represents another frequent underpayment area. The 2021 International Residential Code requires specific ventilation ratios and insulation R-values that many adjusters fail to include in their estimates. For Texas Panhandle homes, Department of Energy guidelines recommend R-38 to R-60 attic insulation to handle extreme temperature variations. When roof replacement occurs, bringing ventilation and insulation up to current code standards should be included in claim calculations.

Professional documentation should include detailed moisture intrusion assessments, as Panhandle wind-driven rain can penetrate compromised roof systems and cause hidden damage to decking and structural components. NRCA standards emphasize the importance of comprehensive building envelope evaluation, particularly after severe weather events. Insurance companies frequently overlook secondary damage indicators like ceiling stains, compromised insulation, and structural moisture that may not be immediately visible during initial inspections.

Working with contractors who understand IBHS Fortified standards can strengthen your claim documentation. These enhanced construction techniques, designed specifically for high-wind regions like the Texas Panhandle, demonstrate industry best practices that support higher-quality repair specifications and help justify comprehensive replacement costs rather than minimal patch repairs.