When filing a roofing insurance claim after storm damage, understanding the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) payouts can mean thousands of dollars in your settlement. These two valuation methods determine how much compensation you'll receive for roof repairs or replacement, yet many property owners don't fully grasp the financial implications until they're deep into the claims process.

What ACV and RCV Mean and Why It Matters

Actual Cash Value (ACV) and Replacement Cost Value (RCV) represent two fundamentally different approaches to calculating insurance payouts for damaged roofing systems. Your policy type directly affects your out-of-pocket expenses and the overall financial recovery from storm damage.

ACV policies calculate payouts based on your roof's depreciated value at the time of loss. This means the insurance company considers the age, condition, and remaining useful life of your roofing materials when determining compensation. If your roof system has been in place for 15 years, the payout reflects that depreciation, even if replacement costs have increased significantly.

RCV policies, conversely, provide compensation based on the current cost to replace damaged roofing materials with new, comparable materials. This approach doesn't factor in depreciation, offering substantially higher payouts that better align with actual replacement expenses in today's market.

Key Factors That Determine Your Payout Amount

Several critical factors influence how ACV and RCV calculations impact your specific roofing claim:

Age and Condition of Roofing Materials

The National Roofing Contractors Association recognizes that roof system lifespan varies significantly based on materials and environmental conditions. For ACV calculations, insurers typically apply standard depreciation schedules:

- Asphalt shingles: 2-4% depreciation annually

- Metal roofing: 1-2% depreciation annually

- Commercial membrane systems (TPO, EPDM, PVC): 3-5% annually

- Tile roofing: 1-2% depreciation annually

These depreciation rates can dramatically reduce payouts on older roofing systems, particularly in the Texas Panhandle where extreme temperature fluctuations and UV exposure accelerate material aging.

Current Material and Labor Costs

RCV policies protect against market inflation and supply chain disruptions that have significantly impacted roofing material costs. Recent years have seen dramatic price increases for asphalt shingles, commercial membranes, and specialized components due to supply shortages and increased demand following widespread storm damage across the region.

Building Code Requirements and Upgrades

Modern building envelope requirements often mandate improved wind uplift resistance and energy efficiency standards that weren't required when older roofs were originally installed. RCV policies typically cover these necessary upgrades, while ACV policies may leave property owners responsible for code compliance costs.

How Payout Structures Work in Practice

ACV Payout Process

ACV claims typically involve a single payment calculated using this formula: Replacement Cost - Depreciation - Deductible = ACV Payout. For example, if your 10-year-old roof requires $25,000 in repairs, but depreciation totals $8,000, your ACV payout would be $17,000 minus your deductible.

RCV Payout Structure

RCV policies often use a two-step payout process. Initially, you receive the ACV amount to begin repairs. Once work is completed and documented, the insurance company releases the recoverable depreciation (the difference between replacement cost and ACV). This structure protects insurers while ensuring property owners can complete necessary repairs with full compensation.

Recoverable Depreciation Timing

Most RCV policies include time limits for claiming recoverable depreciation, typically 12-24 months from the initial loss date. Property owners must complete repairs and submit proper documentation within this timeframe to receive full compensation. For comprehensive guidance on this process, learn more on our residential roofing service page.

Special Considerations for Storm-Prone Areas

The Texas Panhandle's severe weather patterns create unique challenges for both ACV and RCV policyholders. High winds, large hail, and frequent severe storms accelerate roof deterioration and increase the likelihood of claims.

Impact-Resistant Materials and Discounts

Many insurers offer premium discounts for impact-resistant shingles and enhanced wind uplift resistance features. The Insurance Institute for Business & Home Safety has documented significant storm damage reduction with properly installed, impact-resistant roofing systems.

RCV policies better support these protective upgrades by covering full replacement costs for premium materials, while ACV policies may not provide adequate compensation for enhanced storm-resistant features.

Commercial Property Considerations

Commercial roofing systems face additional complexity in ACV versus RCV valuations. Large commercial membrane systems, specialized drainage components, and business interruption considerations require careful policy evaluation. Visit our commercial roofing services section for detailed information about commercial insurance claim processes.

Moisture Intrusion and Secondary Damage

Storm damage often leads to moisture intrusion that compromises building envelope integrity. RCV policies typically provide better coverage for addressing hidden damage and necessary building envelope repairs that become apparent during roof replacement projects.

When to Call a Professional Roofer

Navigating insurance claims requires professional expertise to ensure accurate damage assessment and proper documentation. Experienced roofing contractors understand how to document storm damage, work with insurance adjusters, and maximize claim settlements regardless of your policy type.

Professional roofers can identify damage that property owners might miss, including compromised flashing, granule loss patterns indicating hail impact, and wind damage to roof system components. This thorough documentation becomes crucial for both ACV and RCV claims, as undocumented damage typically isn't covered in settlements.

Additionally, working with qualified contractors ensures repairs meet current building codes and warranty requirements, protecting your investment and maintaining coverage for future claims. See our hail and wind damage repair page for comprehensive storm damage assessment services.

Understanding your insurance coverage before you need it empowers better decision-making during stressful claim situations. Whether you have ACV or RCV coverage, professional roofing expertise ensures you receive fair compensation and quality repairs that protect your property for years to come. Contact CRS Roofing & Construction for a comprehensive roof inspection and insurance coverage consultation tailored to Texas Panhandle weather challenges.

The Texas Panhandle's extreme weather conditions make understanding insurance payouts particularly critical for property owners. With NOAA's National Severe Storms Laboratory documenting frequent severe hail events and wind speeds exceeding 75 mph in the region, roofs face accelerated depreciation that significantly impacts ACV calculations. Modern impact-resistant shingles, such as GAF's Timberline HD series with Class 4 impact ratings, may depreciate more slowly due to their enhanced durability, potentially improving ACV payouts over time.

When documenting storm damage for insurance claims, it's essential to understand how different roofing materials are evaluated under both payout methods. The National Roofing Contractors Association emphasizes that proper documentation should include detailed photographs of granule loss, exposed mat, and structural damage. For commercial properties with TPO or EPDM membranes, depreciation schedules differ significantly from residential asphalt shingles, as these materials typically have 20-30 year useful lives compared to the 15-25 year standard for conventional shingles.

Texas building codes and International Code Council standards require specific wind resistance ratings for the Amarillo region, which falls under high-wind zone classifications. When insurance adjusters evaluate replacement costs, they must account for code-compliant materials that meet or exceed 110 mph wind ratings. This often means RCV policies provide coverage for upgraded materials that exceed the original roof specifications, while ACV policies may leave property owners responsible for the difference between depreciated value and code-compliant replacement costs.

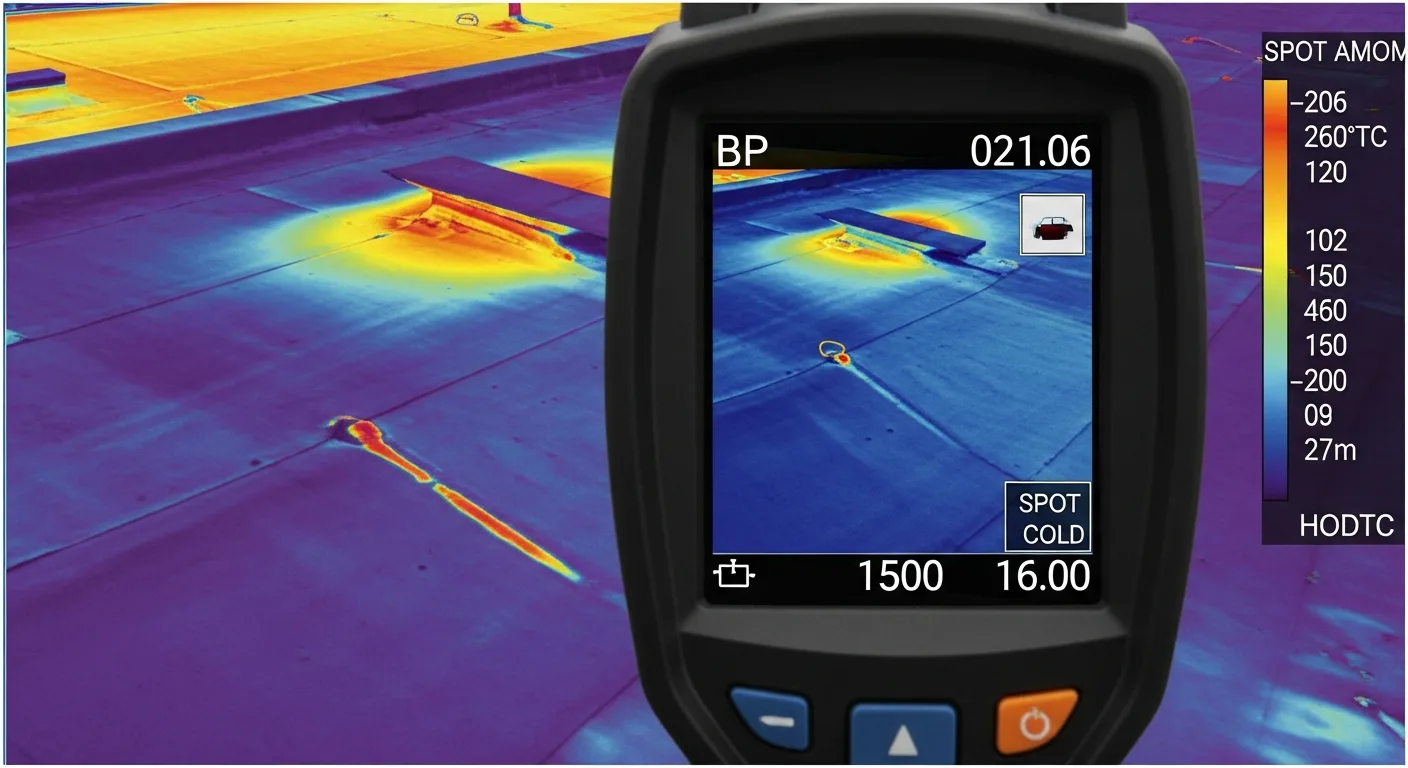

Professional claim documentation becomes crucial in maximizing both ACV and RCV payouts. Insurance Information Institute data shows that properly documented claims with professional roofing contractor assessments result in 23% higher average settlements. This includes thermal imaging to identify hidden moisture damage, core sampling for membrane thickness verification on commercial roofs, and detailed material specifications that account for current market pricing in the Texas Panhandle region, where material transportation costs can add 8-12% to replacement expenses compared to metropolitan areas.